By Graham Summers, MBA

Stocks are bouncing from yesterday’s lows, but the technical damage from yesterday’s bloodbath is severe.

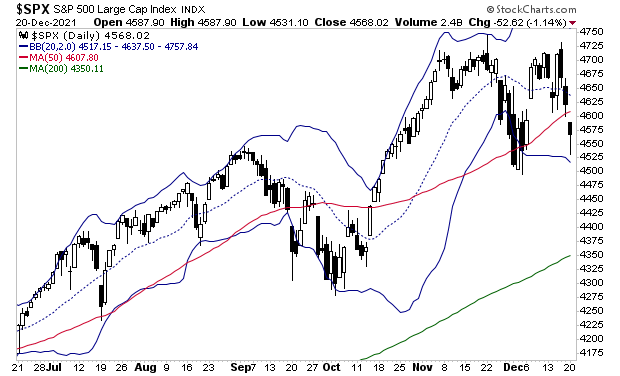

The S&P 500 was stopped by its 50-day moving average (DMA) at 4,607 (see red line in the chart below). Unless the S&P 500 can break above this line, we’re in for MORE downside.

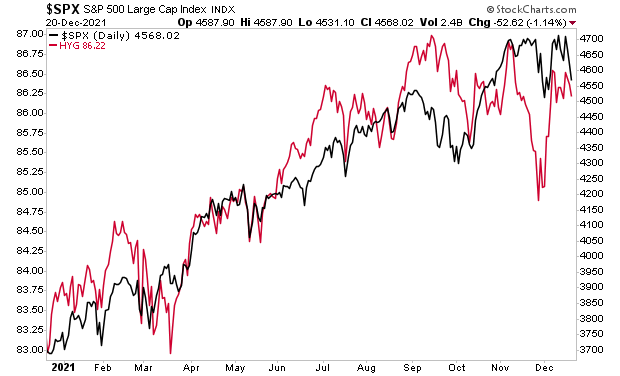

What’s REALLY concerning is the fact that unlike stocks, high yield credit (red line in the chart below) NEVER even revisited its former highs. Instead it’s already turning back down.

Remember, this is THE market leader that signaled the first leg down on this plunge.

This strongly suggests stocks will be revisiting the lows. And unfortunately, that’s the BEST outcome based on what I’m seeing.

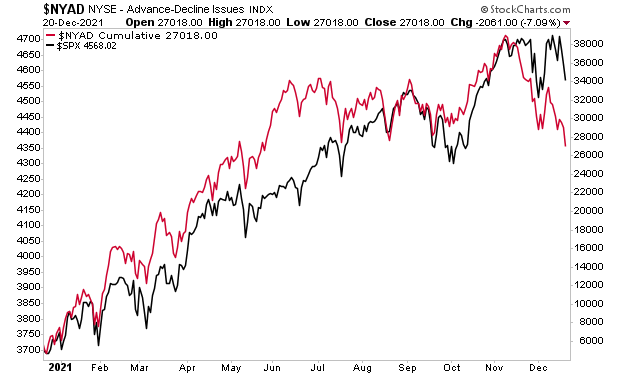

Consider that breadth, which typically leads the broader market, barely bounced at all! And it’s already at NEW lows. Based on this alone, we should see the S&P 500 down in the 4,300s in the near future.

Put another way, another bloodbath is coming. And when it hits, smart investors will cash in while everyone else gets taken to the cleaners.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guidecan show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards,