By Graham Summers, MBA

The markets are about to lose their “training wheels.”

And by the look of things, it won’t be pretty.

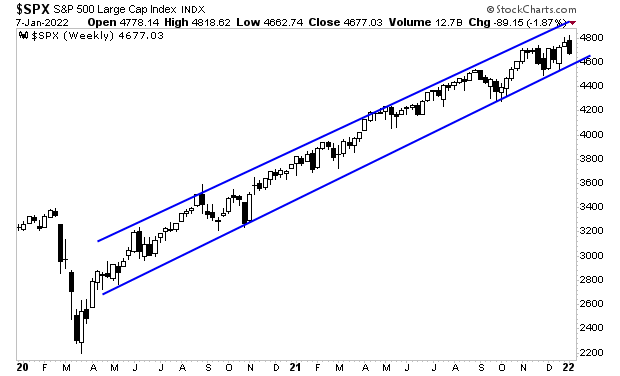

On March 23, 2020, during the depths of the market crash triggered by the economic shutdowns, the Fed moved to backstop everything.

And I do mean EVERYTHING.

The Fed On Monday March 23nd, 2020, the Fed staged an Emergency Meeting during which it announced that it would be expanding its $700 billion QE program to “unlimited”… meaning it would print as much money as was needed.

It also announced that it would be using this unlimited QE to fund various credit facilities that would buy:

· Mortgage-Backed Securities (MBS)

· U.S. Treasuries

· Corporate debt or debt issued by corporations.

· Corporate debt-related ETFs (stock funds linked to corporate debt).

· Municipal debt (debt issued by states, counties, and cities).

· Certificates of Deposit (CDs)

· Student Loans

· Auto Loans

Since that time, stocks have ripped higher in a near straight line…

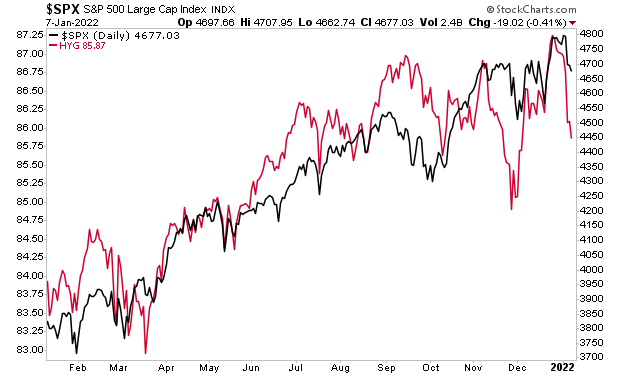

The Fed, nearly two years later, finally decided to its time to end the interventions. Within eight weeks its current QE program will be over. And the Fed intends to start raising rates soon after.

So, what will the market look like once the Fed stops its nearly weekly interventions?

High yield credit is already offering a preview. The Fed stopped intervening in this market weeks ago.

The signs are clear… another bloodbath is just around the corner.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guidecan show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards,