Three weeks ago, I told our clients that I believed the stock market would act in such a way as to induce the greatest amount of suffering to the greatest number of investors.

This meant the market trading in a “chopping” fashion, moving in a large range designed to hurt bulls and bears alike.

In simple terms, when stocks get to the top of the range, the bulls will get excited only to see stocks roll over and drop back down. And similarly, when stocks get to the bottom of the range, the bears will get excited, only to then see stocks rally hard.

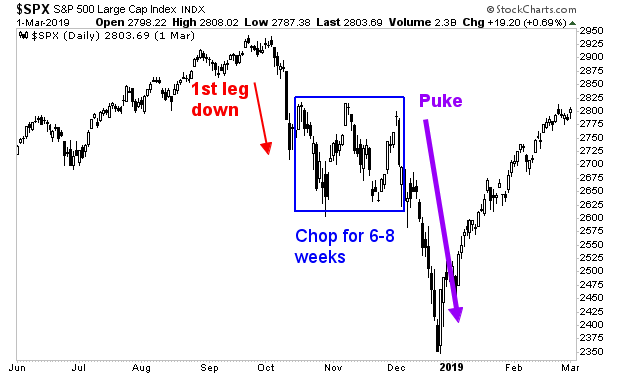

Indeed, this whole pattern since the start of the year has been reminiscent of the late-2018 market collapse. That represents the last time the Fed attempted to normalize policy, only to backtrack once something “broke.”

That pattern was:

- An initial leg down

- Several weeks of chop

- A final puke to new lows.

In chart form, it looked like this:

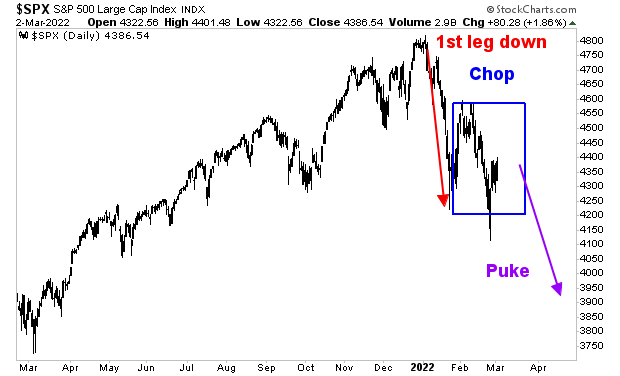

In terms of today’s market, the first leg down occurred in late January. We are now 3-4 weeks into the “chop” which means the final puke to new lows is just around the corner.

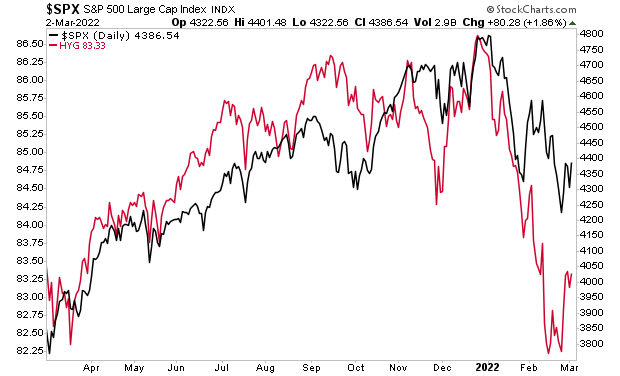

High yield credit is warning us about this in a big way.

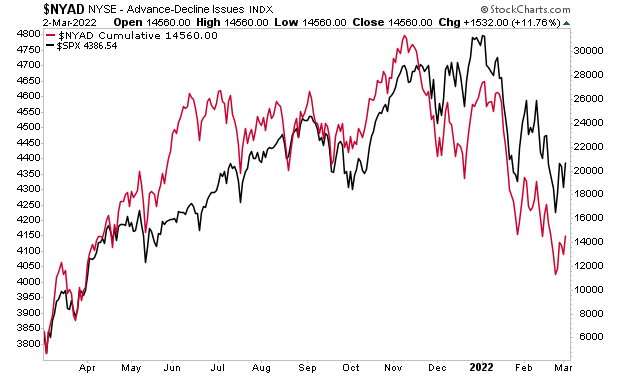

So is breadth.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html