By now, you’re no doubt getting pretty worried about the markets.

After all, why wouldn’t you?

Russia has invaded Ukraine which has massive implications for natural resources. Oil is over $120 a barrel. The stock market is already down over 10% from its recent highs.

It’s enough to stress anyone out!

Well, unfortunately we now need to add the following: the U.S. will likely enter a recession late this year or early in the next.

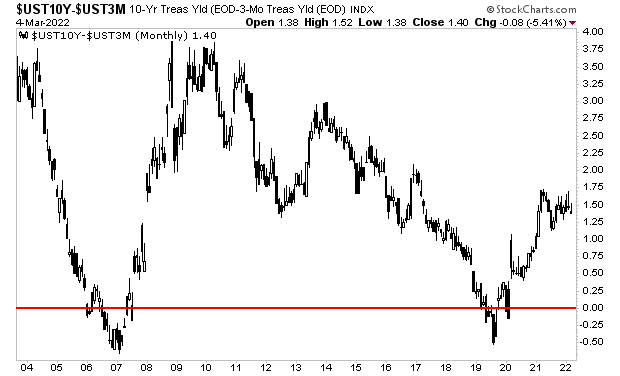

According to the Fed’s research, the most accurate predictor of a recession is the 10-year/ 3 month U.S Treasury yield curve, or the difference between the yield on the 10-Year U.S. Treasury and the yield on the 3-month U.S. Treasury.

Whenever this yield curve breaks below 0%, the U.S. has entered a recession. I’ve identified this level on the chart below.

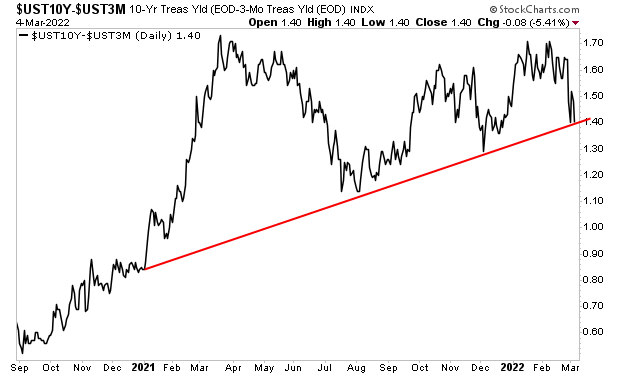

The bad news today is that this yield curve is currently rolling over in a big way.

As I write this, it’s about to take out its upward trendline (red line in the chart below). This would mean that the yield curve is no longer trending in a positive manner but is heading downwards to the dreaded ZERO that predicts a recession.

Put another way, a break of this level would almost assuredly trigger a yield curve inversion… which would mean a recession is just around the corner.

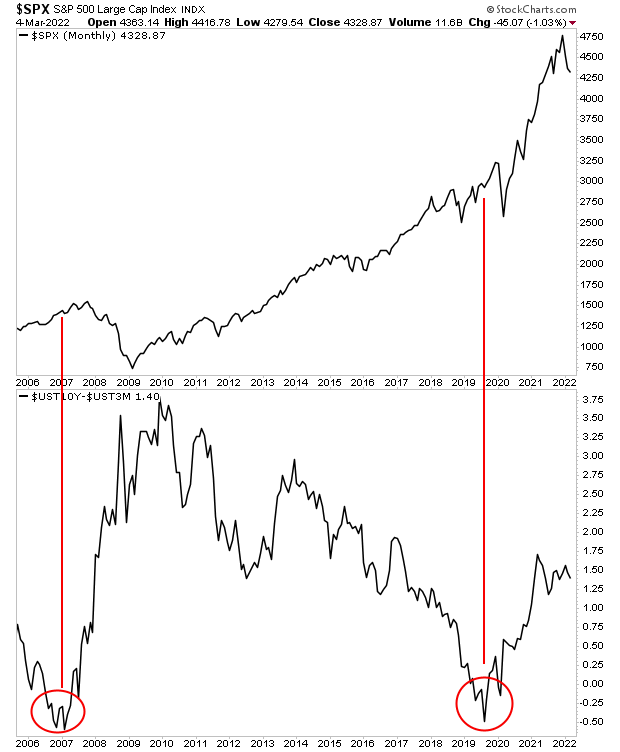

Please note, the last two recessions triggered stock market crashes. The yield curve inverted a mere six to nine months before the crash hit. This means we can expect a full blown crash some time later this year or early in the next

You’ve been warned.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html