By Graham Summers, MBA

The bond market is telling us that the Fed is in very serious trouble.

Bonds are quite complicated, so I’m going to do my best to keep things very simple here.

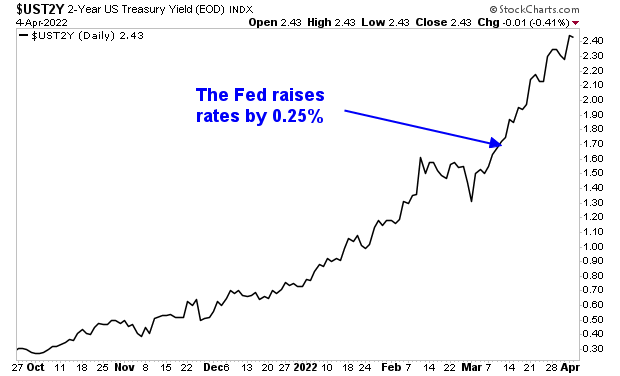

The Fed ended its Quantitative Easing (QE) program through which it prints new money and used it to buy assets from Wall Street in early March. Since that time, the Fed has also begun raising interest rates, implementing its first rate hike of 0.25% on March 17th.

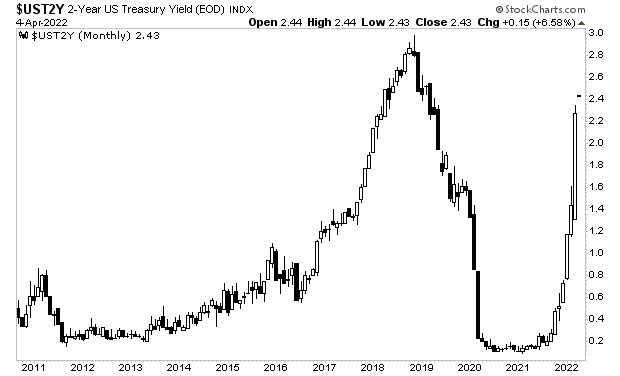

Historically, when the Fed begins raising interest rates, it looks to the 2-Year U.S. Treasury for guidance: the Fed tracks the yield on this bond as a proxy for where rates need to go.

With that in mind, the yield on the 2-year Treasury, is exploding higher. In six months, it has moved approximately the same amount that it did from 2012-2018!!! This is a truly incredible move, and it tells us the Fed is WAYYYY behind the curve in terms of where interest rates need to go.

If you think that’s disturbing, consider the following…

This yield on the 2-year U.S. Treasury is HIGHER now than it was before the Fed raised rates a few weeks ago. This means the Fed is MORE behind the curve now than it was before it actually raised rates!

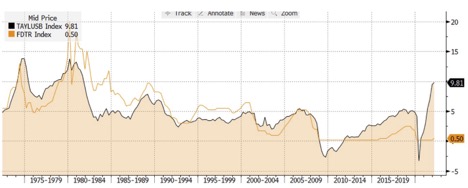

We know from the inflationary storm of the late 1970s/ early 1980s that once the Fed gets really behind the curve on inflation, small moves no longer work. The Fed will NEED to be EXTREMELY aggressive going forward to stop inflation.

How aggressive?

Bill King notes that the Taylor Rule suggests rates need to be over 9.5% to stop inflation. Yes, 9.5%. Rates are at currently at 0.5%!

If you think the Fed is going to back off on its monetary tightening, you’re mistaken. The Fed HAS to move and move aggressively if it wants to stop inflation from completely destroying the economy.

This will mean the Fed intentionally triggering a recession within six months. It has no other choice. It has to end inflation and the only way to do so is to crush demand via a recession.

The time to prepare for what’s coming is NOW, before it hits.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html