By Graham Summers, MBA

The market is once again on thin ice.

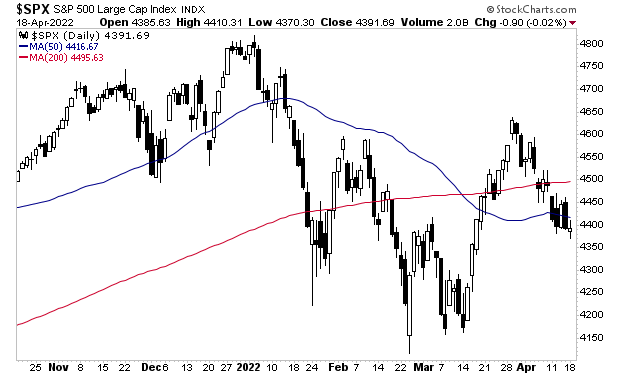

The S&P 500 cannot even maintain its 50-day moving average (DMA). And this is despite the Fed pumping $55 billion into the financial system in the last month. Moreover, the 50-DMA is rolling over again. All of this is quite bearish.

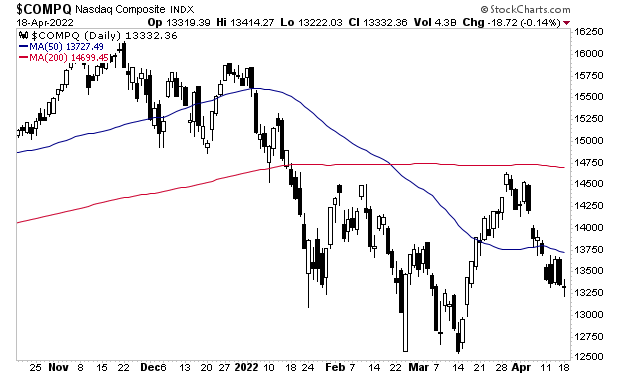

The picture is even uglier for the NASDAQ. Tech stocks broke back below their 50-DMA last week. They have since failed to reclaim it. Again, this is quite bearish.

At the end of the day, the only thing holding up stocks is the fact retail investors keep “buying the dip.” Having been conditioned to believe stocks never go down courtesy of two years of Fed interventions, this crowd continues to buy at every opportunity. They’ve collectively poured $40 billion into U.S.-based stock funds in the last six weeks.

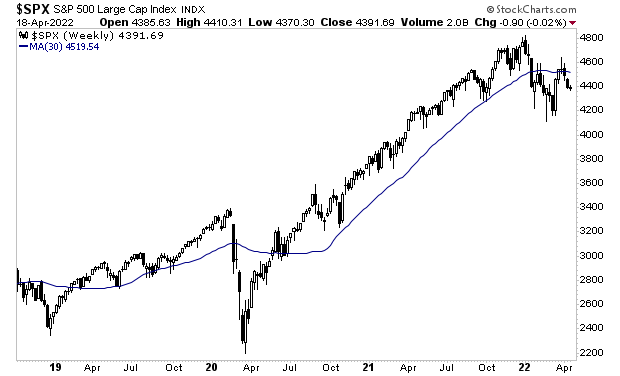

I’m guessing no one showed them this chart:

The market is on thin ice. The next bloodbath is just around the corner.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html