By Graham Summers, MBA

Yesterday I noted that the bond market is crashing.

By quick way of review:

1) The Fed is horribly behind the curve on inflation. This has resulted in Treasury yields spiking as Treasury bonds collapse.

2) The pace of the spike in yields is truly historic: in six months, they’ve moved the same amount as they did in three years from 2003 to 2006 and in six years from 2012-2018.

3) The last time bond yields spiked like this was in 2018. At that time the corporate debt markets froze and stocks crashed 20% in a matter of weeks.

Unfortunately, this isn’t the end of the bad news either!

The 10-year U.S. Treasury is the single most important bond in the world. The reason for this is that A) it is issued by the U.S., which is the largest, most dynamic, economy in the world and B) 10 years represents a full economic cycle.

The yield on this bond has just broken out of its 35+ year downtrend for the second time in decades.

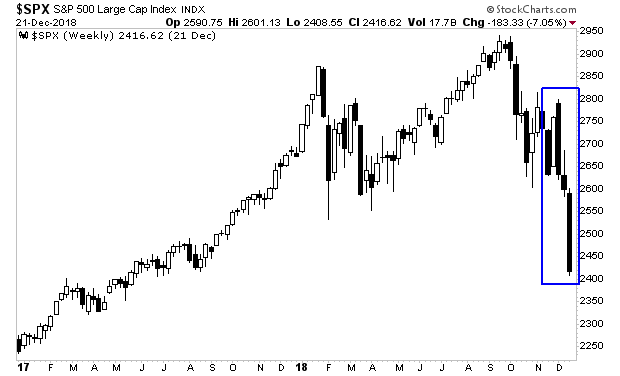

As the above chart shows, the first break took place in 2018.

As I mentioned yesterday, at that time the Fed was raising rates four times a year while also shrinking its balance sheet by $500 billion. The end result was the junk bond market froze and stocks crashed (see blue rectangle in the chart below). This forced the Fed to abandon tightening monetary policy.

By way of contrast, during this latest breakout of the yield on the 10-Year U.S. Treasury, the Fed has only just ended QE, has yet to shrink its balance sheet at all, and has only raised rates ONCE.

Again, this is a HUGE freaking deal. Last time this happened the Fed could start easing monetary conditions to stop the carnage. This time around, the Fed CANNOT. It has to continue tightening monetary policy or risk inflation destroying the economy.

Put simply, the Fed needs to decide… does it save stocks or bonds.

Saving stocks means risking a debt crisis that would make 2008 look like a picnic.

Savings bonds means stocks collapsing… but the system remains intact.

Which do you think the Fed will choose?

The stage is set for a historic collapse. It might not be today or tomorrow… but it’s coming.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html