By Graham Summers, MBA

The Fed’s lying again.

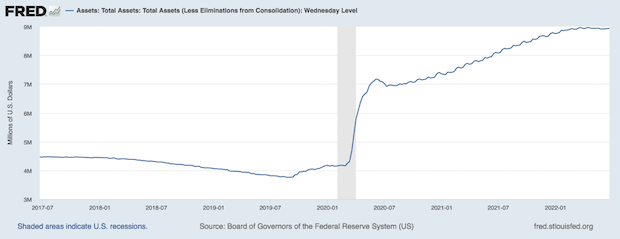

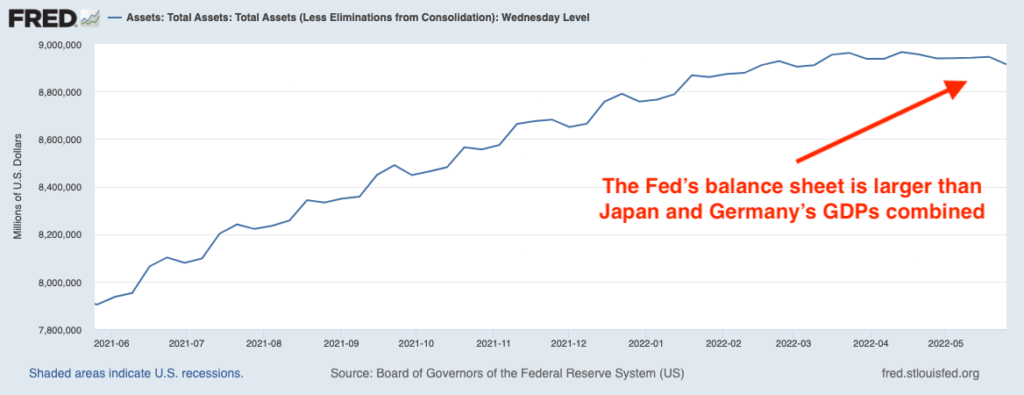

One of the BIGGEST LIES in financial history was the Fed’s claim that there was no inflation or that inflation was transitory in 2021.

How do I know this was a lie?

Because the Fed’s own research contradicted its claim!

If you’re unfamiliar with the Fed’s Beige Book, it’s a report the Fed publishes eight times per year.

In it, the 12 regional banks that comprise the Fed present anecdotal information on the U.S. economy. The Fed retrieves this information via interviews and conversations with business leaders, market experts and other people at the frontlines of the economy.

And throughout 2021, all of these people were SCREAMING that inflation was a major problem. In fact, the complaints about “rising costs” and “needing to raise prices” started as early as March 2021.

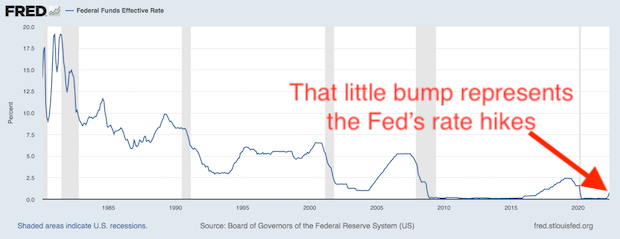

Despite this, the Fed argued that inflation was non-existent or would disappear shortly for another six months. We all know how that turned out. The Fed capitulated, inflation is roaring, and we’re all suffering as a result.

And unfortunately for us, the Fed is now pushing another WHOPPER of a lie.

That lie?

That the economy won’t enter recession later this year or the next.

How do I know this is a lie?

You guessed it… because the Fed’s own research contradicts it!

A recession is denoted by a prolonged period of economic contraction. And as everyone knows, the U.S. economy contracted in the first quarter of 2022. So if it contracts again in the second quarter… we’d be in recession.

The Fed runs a service called GDPNow that measures the economy in real time. According to this measure, the economy is flatlining in the second quarter. Sure, the beancounters might be able to massage the data to make it look as if the economy grew by a little bit… but look around you… does the economy feel like it’s booming to you?

It sure doesn’t to me. If anything it feels as if things took a major turn for the worse months ago.

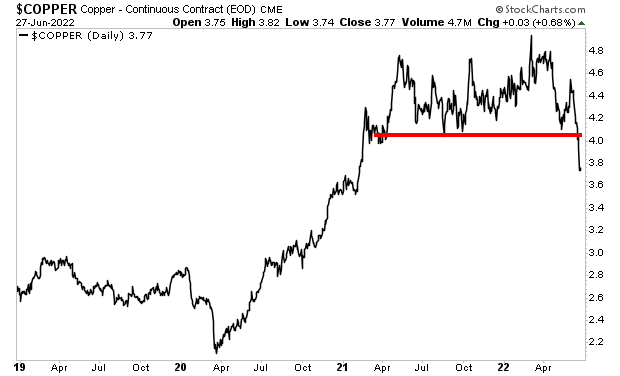

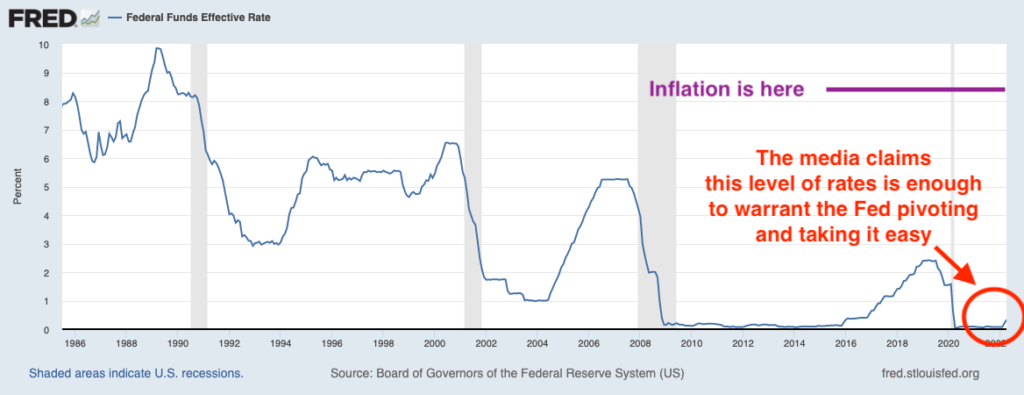

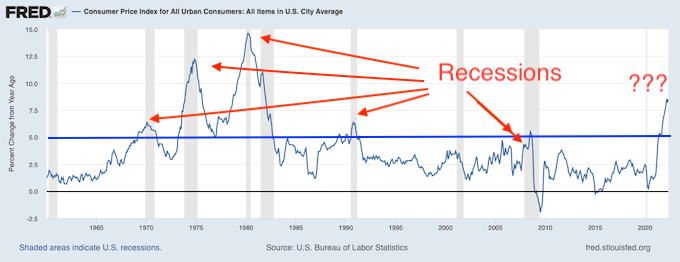

And why wouldn’t they? After all, history has shown us that ANY TIME inflation breaks above 5%, the U.S. economy enters a recession. And inflation cleared 5% in September of last year!

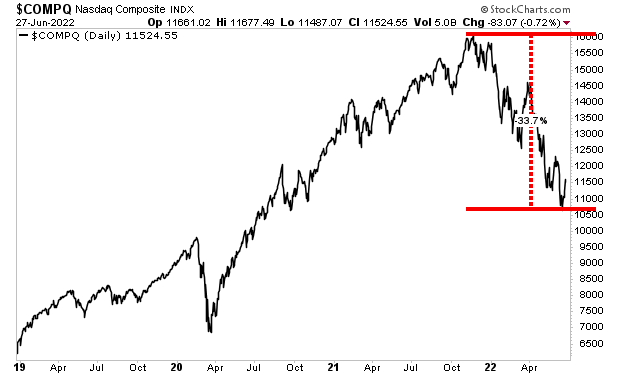

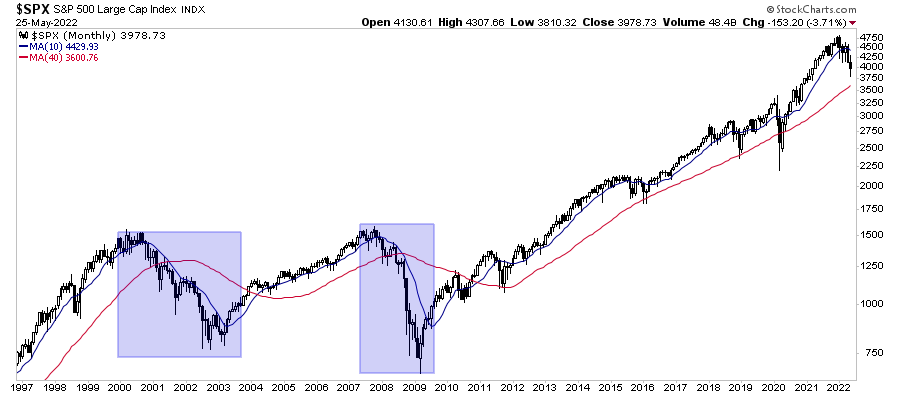

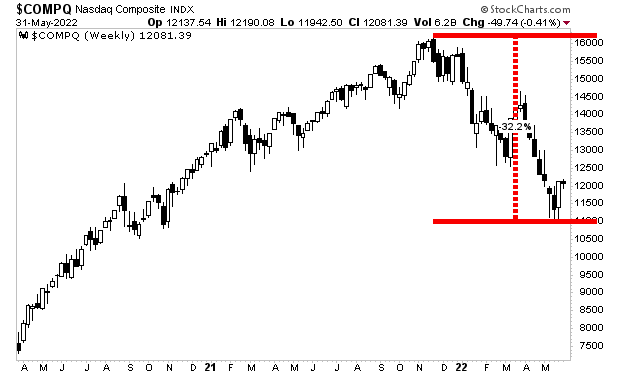

Let’s cut through the BS here. We all know the U.S. is in recession. And we also know that by the time the Fed admits it, the market will have already collapsed to levels most investors don’t even want to imagine.

I’ll detail just how low stocks could go due to the recession in tomorrow’s article. In the meantime we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We made 100 copies to the public… and they are going fast.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html