By Graham Summers, MBA

Let’s consider this latest stock market rally.

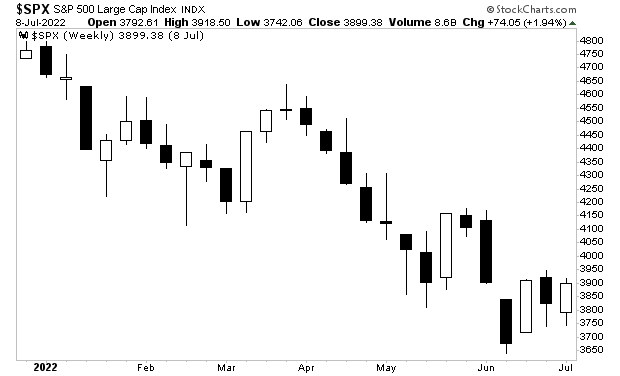

First and foremost, the price action for stocks in 2022 had been EXTREMELY bearish. The S&P 500 experienced EIGHT consecutive down weeks from late March until mid-May of 2022. Even more striking, from mid-March until early July, only THREE out of the 15 weeks had been up.

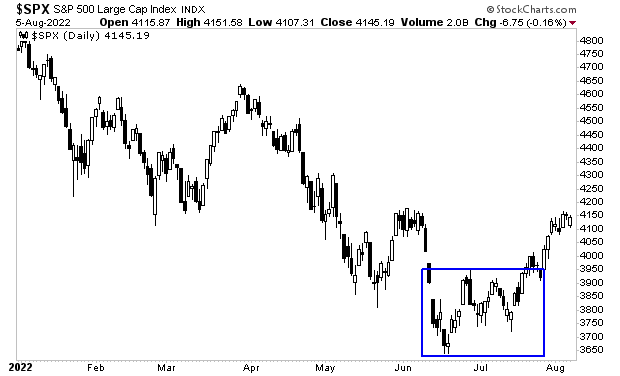

Historically, in any given week, stocks rally 56% of the time. So, the stock market’s performance has been extremely unusual in 2022. In this context, the market was overdue for a significant rally when stocks began to form a base in June-July.

Indeed, at the June lows, the S&P 500 was trading a whopping 11% below its 50-day moving average (DMA). I’ve illustrated this level in the below chart with a blue line. As you can see, this is an extremely rare occurrence having only happened two other times in the last 10 years: the COVID crash and the Fed 2018-policy error which blew up the debt markets.

My point is that stocks were EXTREMELY oversold and stretched to the downside in mid-June of 2022. So, the stage was set for a bear market rally.

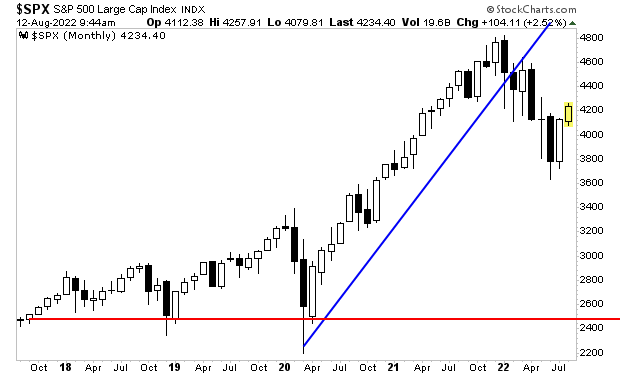

However, I have to emphasize that this is a bear market rally. Which means the next leg down is coming. The below chart tells us the story… though it’s not one the bulls want to see.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Today is the last day this report is available to the public.

We extended our offer by an additional 24 hours due to the holiday weekend, but this is it… no more extensions!

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards