On Friday I outlined the technical setup for the stock market’s current bear market rally.

By quick way of review…

- The price action in 2022 had been extremely bearish with 12 out of the previous 15 weeks closing down as of mid-June.

- The S&P 500 was extremely extended below its 50-day moving average (DMA)… hitting a low of 11% below that line in early June.

Put simply, the markets were primed for a bear market rally. After all, EVERY major bear market experiences these.

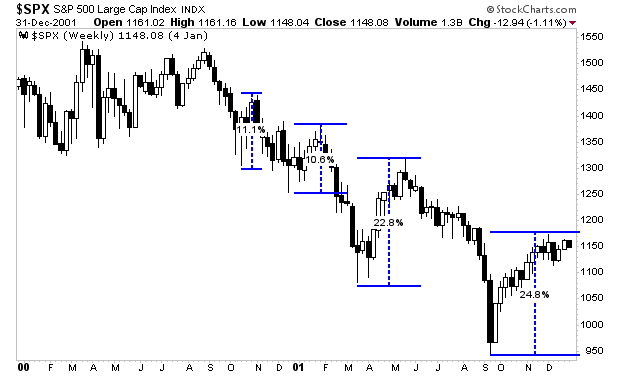

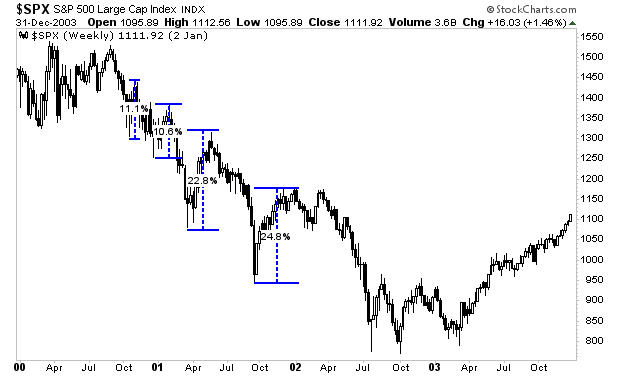

It is not uncommon for stocks to rally quite a lot… and for several weeks if not months, during bear markets. During the first 12 months of the Tech Crash, the stock market experienced two rallies of ~10 each lasting over a month in length, as well as two rallies of ~20+%, both of which lasted two months.

However, despite these significant rallies, stocks continued down another year, finally starting the bottoming process in late 2002.

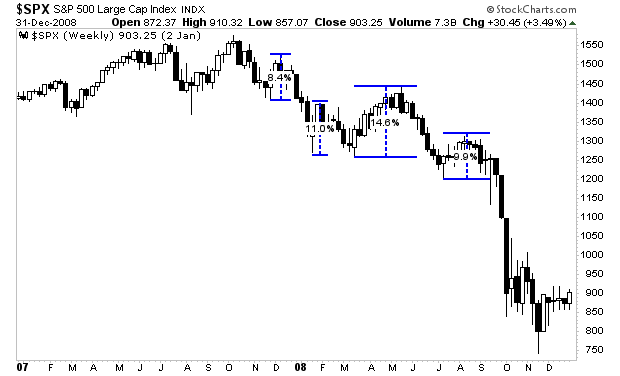

Similarly, during the Housing Bust, there were four stock market rallies of 10%-15%, each lasting three weeks or more. Again, each of these ended in misery with stocks plunging an additional 50% before the market bottomed in 2009.

My point with all of this is that bear markets are extremely dangerous because stocks don’t go straight down. Instead, the stock market frequently experiences significant ~10+% rallies that can last as much as two months.

Just like this current rally.

I’ll outline when the next leg down in this secular bear market will begin in tomorrow’s article… in the meantime, if you’re looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html