By Graham Summers, MBA

As I noted yesterday, Japan has unleashed the next wave of inflation.

By quick way of review:

1) Japan’s central bank, the Bank of Japan or BoJ, is the only major central bank that is still easing monetary conditions: both the Fed and the European Central Bank (ECB) are tightening monetary conditions.

2) As a result of this differential in policy, Japan’s currency, the Yen has hit a 24-year low relative to the $USD.

3) Japan imports almost all its energy and food needs. As a result of this currency collapse, food and energy prices in Japan are skyrocketing.

So last week, the BoJ decided to take matters into its own hands… and intervene directly in the currency markets. This is an actual gamechanger.

Why?

Because Japan is now EXPORTING inflation to the U.S. and Europe. How long do you think the U.S. and Europe will tolerate this?

And so… we have entered the currency wars, a time in which major countries use monetary policy as a weapon to defend their own currencies against others.

All of this is HIGHLY inflation.

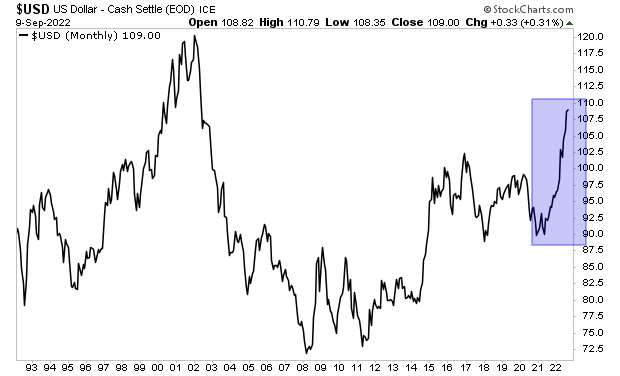

Consider the U.S.. If inflation hit a 40 year high at a time when the $USD was doing this:

What do you think happens to inflation when the $USD rolls over due to Japan propping up the Yen?

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:https://phoenixcapitalmarketing.com/inflationstorm.html