By Graham Summers, MBA

Let’s talk about market structure.

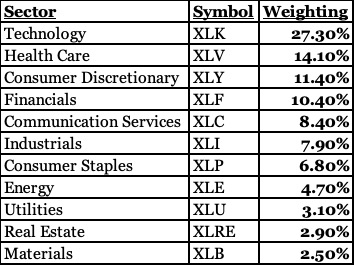

The S&P 500 is extremely weighted towards Tech stocks. Tech is the largest sector by weighting. It is in fact larger than the weighting of the 2nd and 3rd largest sectors combined.

Put another way, the S&P 500 is in fact largely a proxy for the Tech sector.

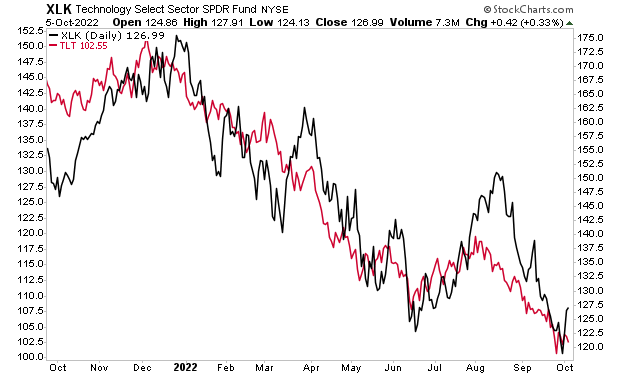

Now, Tech stocks are highly sensitive to long-term rates. You can see this clearly in the below chart in which the Tech Sector ETF (XLK) closely follows the price movements of the Long-Treasury ETF (TLT) albeit with greater volatility.

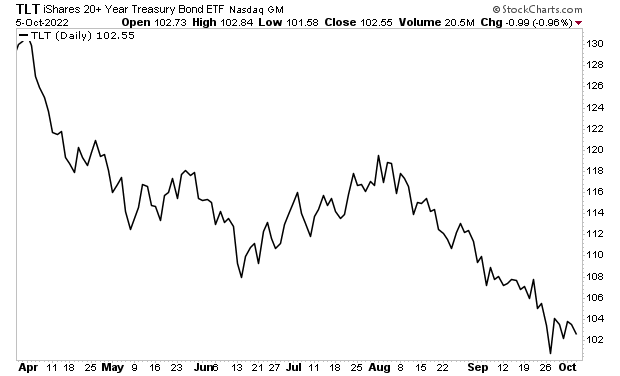

I mention all of this because the Long-Treasury ETF (TLT) is rolling over again.

This suggests the current rally in stocks is on borrowed time. Enjoy it while it lasts.

At the end of the day, the stock market can rally all it wants, but it will all be in vain.

Why?

Because the Great Crisis… the one to which 2008 was a warm-up, has finally arrived.

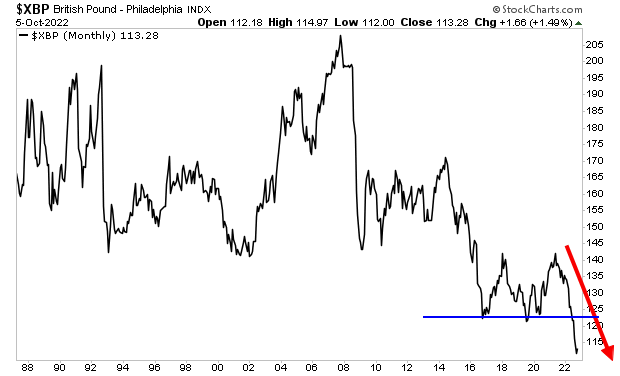

I’m talking about the crisis in which entire countries go bust.

Take a look at what is happening with the British Pound. THIRTY YEAR LOWS and dropping like a stone.

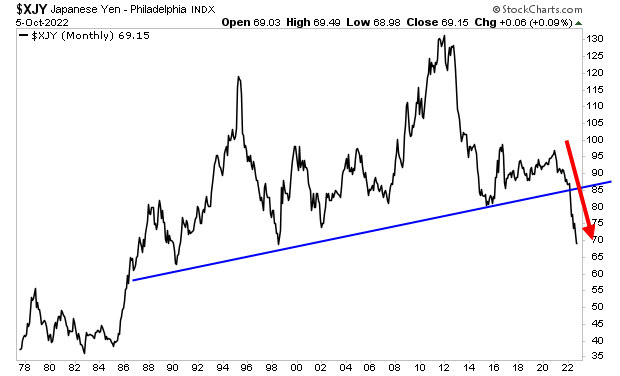

How about the Japanese Yen…25 year lows and no end in sight!

Stocks are in la la land… just like they were before the Tech Crash, the Housing Crash… and now the Everything Bubble Crash.

Meanwhile, smart investors are preparing for what is coming…

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Today is the last day this report is available to the public.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html