By Graham Summers, MBA

Bad news for anyone who’s bullish.

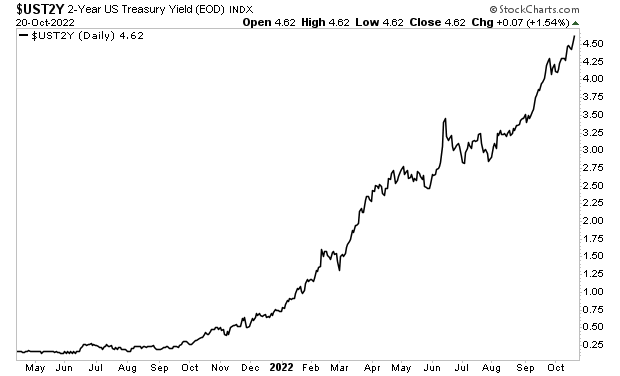

The yield on the 2-year U.S. Treasury just hit a new high.

This entire collapse in stocks thus far in 2022 has been due to Treasury yields rising. Put another way, until Treasury yields STOP rising, stocks will continue to drop.

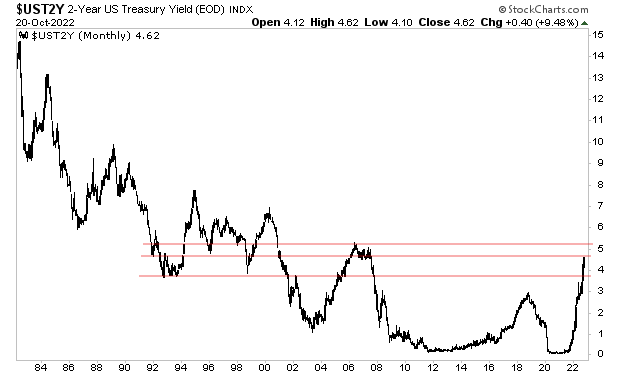

With that in mind, the long-term chart for the yield on the 2-year U.S. Treasury is a disaster. Every line of resistance is being taken out. As I write this Friday, the yield is well on its way to 5%.

The implication for stocks is terrible.

If you can make 5% risk free from Treasuries… stocks lose much of their attractiveness. What becomes the fair value for the S&P 500?

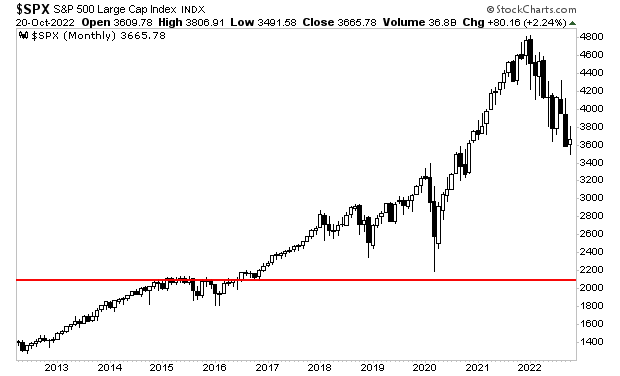

14 times forward earnings or 3,300?

12 times forward earnings at 2,760?

Somewhere lower?

During the last major inflation-induced bear market in the 1970s, stocks traded at a single digit P/E. Even if it’s 9 times forward earnings, you’re talking about 2,070 on the S&P 500 today.

That’s the red line below.

As I keep stating, the Great Crisis… the one to which 2008 was a warm-up, has finally arrived. In 2008 entire banks went bust. In 2022, entire countries will do so.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Today is the last day this report will be available to the public.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html