By Graham Summers, MBA

The financial system is currently experiencing a “relief rally.”

For the eight weeks ending October 28th, the primary problems facing the financial system were:

1) The collapse of the British Pound/ UK Government Bonds

2) The collapse of the Japanese Yen.

3) The collapse of U.S. Treasuries.

All of those have been resolved temporarily, courtesy of the Truss Government resigning in the U.K., the Bank of Japan making its largest intervention ever in the currency markets, and U.S. Treasuries catching a bid, courtesy of Treasury Secretary Janet Yellen verbally intervening to help the Biden Administration with the mid-term elections.

All of these solutions are temporary however.

The fact is that the U.S. is in an inflationary recession. I know it. You know it. Policymakers know it, though they have to lie to prop up the bogus narrative that everything is under control.

It’s not.

The financial system has already erased more wealth in 2022, than it did in 2020 or 2008. During those prior crises, bonds rallied providing a hedge against the collapse in stocks.

Not this time.

Bonds AND stocks are both collapsing, erasing over $18 trillion in wealth. And bear in mind, that’s NOT counting the loss of capital in housing or other asset classes.

And unfortunately for the bulls, we are nowhere near the bottom for either stocks or bonds.

Stanley Druckenmiller is arguably the greatest investor alive today. He averaged 30% a year for 30 years straight. And he notes that historically, whenever inflation gets over 5%, inflation never comes down until the Fed raises rates ABOVE CPI.

Currently, rates are 3.0-3.25%.

CPI is over 8%.

We have a looooong ways to go here. And there is plenty of historical data to back that up.

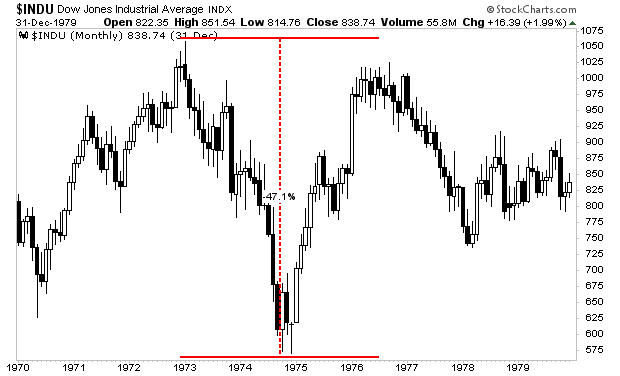

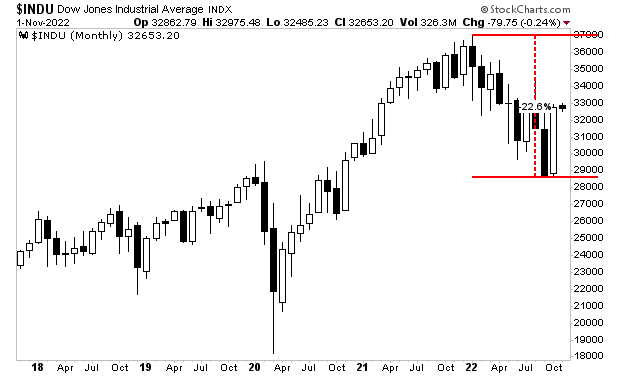

During the last stagflationary crisis in the 1970s, stocks lost 50% of their value before bottoming.

Thus far, in 2022, stocks have only lost 22%. If we are LUCKY, we are half way through this bear market.

Who would you rather bet on being correct… an investment legend like Druckenmiller, who has one of the greatest track records in history… or the Fed or some other establishment shill whose job it is to claim everything is great?

A crash is coming. And it’s going to make 2008 look like a joke. I coined the term the “Everything Bubble” in 2014. I warned about it for the better part of 10 years.

And it has officially burst.

On that note, we are putting together an Executive Summary outlining how to invest now that the Everything Bubble has burst.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html