By Graham Summers, MBA

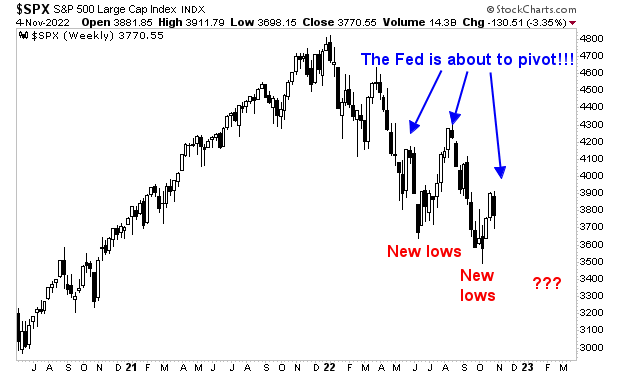

Yesterday I illustrated that the Fed has NOT pivoted and won’t be for months. Anyone who says otherwise isn’t listening to what the Fed is actually saying!

Reviewing the Fed’s public statements since March 2022 (the month it began tightening monetary conditions), nowhere is there any hint or mention of a Fed pivot.

If anything, even formerly dovish Fed officials like Neel Kashkari (President of the Federal Reserve Bank of Minneapolis) or John Williams (President of the Federal Reserve Bank of New York) reveals that they are all inflationary hawks!

However, this hasn’t stopped the shills in the media from pushing the narrative that the Fed is about to pivot. And has been the case multiple times this year, investors have fallen for this narrative, piling into stocks.

The latest Fed pivot-induced rally began in mid-October. It went into hyperdrive on October 21, when Nick Timiraos, a Wall Street Journal reporter who is believed to be a Fed conduit in the media, published an article titled, Fed Set to Raise Rates by 0.75 Point and Debate Size of Future Hikes.

At the time, the Fed was in a “blackout” period in which Fed officials couldn’t make public appearances to dissuade the investing public from interpreting this article as suggesting a Fed “pause” and possibly even a “pivot” in monetary policy were at hand.

This presented under performing fund managers with a golden opportunity.

Many funds (both mutual and hedge) have performed TERRIBLY this year. With numerous large financial institutions’ fiscal years ending October 31 (Fidelity, Vanguard, etc.) and November 15th serving as the date by which large investors need to alert hedge funds of their intentions to withdraw money, fund managers were under TREMENDOUS pressure to game performance going into month-end and mid-November.

In this context, the Timiraos article published on October 21, 2022, was the perfect excuse to ramp stocks higher based on the ignorant and deceptive notion that the Fed was about to pivot.

THAT is why stocks have been rallying.

Not because the macro situation has improved (it hasn’t) Not because the Fed or Fed officials have hinted at a pivot (they haven’t). Not because the inflation data is improving (it isn’t). But because fund managers were desperate for any excuse to push stocks higher, and a supposed Fed conduit in the financial media gave them that excuse.

Full stop.

So where do we go from here?

I’ll detail that in tomorrow’s article. For now, the key item to note is that the Everything Bubble has burst.

On that note, we are putting together an Executive Summary outlining how to invest in this new bearish environment.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html