By Graham Summers, MBA

Over the last 25 years, the financial system has been in what I call the “era of serial bubbles”: a time in which central banks create asset bubbles, said asset bubbles burst, and central banks respond by creating another, larger bubble in a more systemically important asset class.

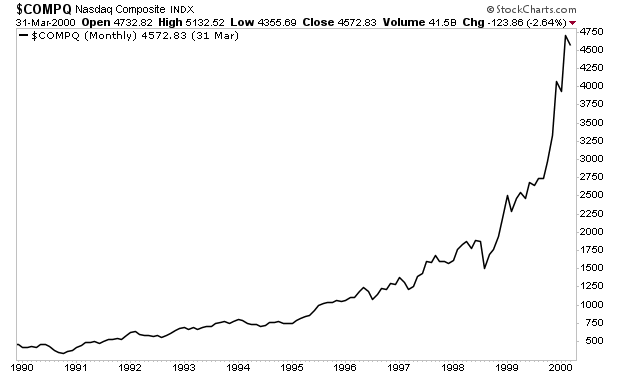

The first primary bubble was the Tech Bubble of the late 1990s. While that bubble was isolated to a particular sector in a particular asset class (Tech Stocks), it was egregious in scope. A third grader could have looked at a chart of the NASDAQ and told you the situation wouldn’t end well.

When that bubble burst, the Fed opted to create another bubble by employing extraordinary monetary policies. Specifically, the Fed kept interest rates too low for too long, essentially making credit free. And because congress passed legislation that lowered lending standards to potential homeowners, the subsequent bubble took place in real estate: a much larger, systemically important asset class.

However, this time around, the bubble became truly global in scope, courtesy of Wall Street derivatives that the Fed ignored/ refused to regulate. In simple terms, Wall Street packaged up garbage mortgages into “assets” that were sold to everyone from hedge funds to pension funds, banks and more. In this manner, toxic mortgages in Florida, Las Vegas, etc. ended up on the balance sheets of everyone from Japanese banks to Spanish hedge funds.

So, when the housing bubble burst, all of these assets had to be revalued at much lower values… resulting in the global banking system imploding during the Great Financial Crisis of 2008.

What did the Fed do to address this situation?

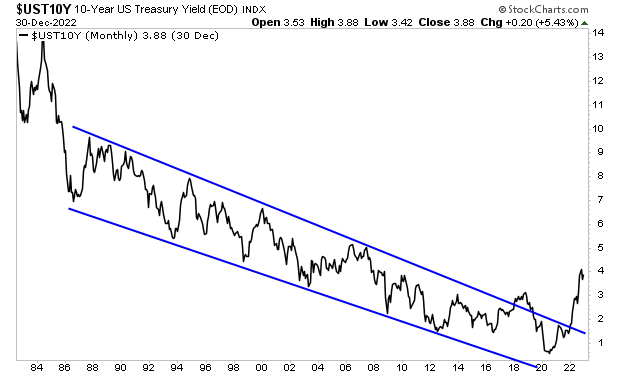

It attempted to corner/ create a bubble in U.S. sovereign bonds, also called Treasuries.

These are the senior most asset class in the world. These bonds act as the bedrock of our current financial system, with their yields representing the “risk free” rate of return against which all assets (stocks, bonds, real estate, etc.) are valued.

Put simply, when the Fed created a bubble in these bonds it was actually creating a bubble in EVERYTHING, because ALL asset classes would eventually be repriced based on Treasuries were doing.

This is why I coined the term “the Everything Bubble” in 2014.

And that bubble has now burst.

The yield on the all-important 10-year U.S. Treasury has broken its 35 year down trend. The era of Serial Bubbles is over. And there is nothing the Fed can do to fix this situation.

After all, what can it do? There isn’t a larger more systemically important asset class the Fed could use to create another bubble. And introducing more extraordinary monetary policy would make the situation worse.

What does this mean?

The Great Crisis of our lifetimes is finally here.

I’ll detail what’s coming for the markets in tomorrow’s article. In the meantime, if you’ve yet to take steps to prepare for this crisis, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM.html