By Graham Summers, MBA

In 2014, I coined the term “the Everything Bubble” to describe the Fed’s insane monetary policies. By quick way of review, after the Great Financial Crisis of 2008, the Fed created a bubble in U.S. sovereign bonds, also called Treasuries.

The Fed did this by cutting interest rates to zero and introducing large-scale Quantitative Easing (QE) programs to the tune of $3.5 trillion. The end result was that the entire Treasury curve was repriced at extraordinarily low levels of risk.

Because these bonds are the bedrock of our current financial system, and their yields represent the “risk free” rate of return against which all risk assets (stocks, bonds, real estate, etc.) are priced, when the Fed created a bubble in Treasuries, it ended up creating a bubble in EVERYTHING.

This is why I coined the term “the Everything Bubble.” And in 2017 I published a best-selling book by the same name (The Everything Bubble: The Endgame For Central Bank Policy), explaining what the Fed was doing and what the final outcome would be.

That outcome?

That the Everything Bubble would burst, just like the Tech bubble of the 1990s and the Housing Bubble of the ‘00s. And when this happened, it would bring about the worst financial crisis of our lifetimes.

That process has now begun. Last year, 2022, was one of the worst years for the financial system in history.

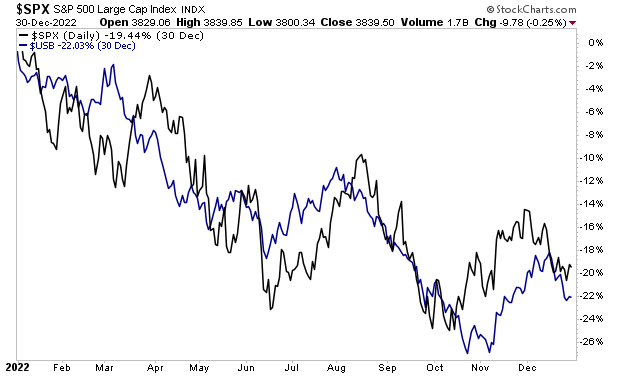

It was literally the worst year for bonds on record, with bonds losing anywhere from 4% to 22% depending on the duration of bonds you owned.

The situation wasn’t much better for stocks. The S&P 500 finished the year down 18%, making it the seventh worst year running back to 1920. The only years during which stocks performed worse than this were during the during major financial crises or during a severe recession/ depression.

And unfortunately, this is just the beginning.

Unlike the Great Financial Crisis or the collapse of 2020, this process will NOT be quick. The reason is quite simple: during those situations the Fed was able to introduce extraordinary monetary policy to cushion the collapse.

This time it cannot.

The entire reason the Everything Bubble burst was because the Fed maintained its emergency level monetary policies for far too long. The recession of 2020 supposedly ended in May of that year, but the Fed printed $2.6 TRILLION after this, while also keeping interest rates at zero.

The Fed wasn’t the only one. Between multiple Stimulus programs and as well as socialist schemes disguised as infrastructure/ fiscal stimulus, the U.S. government has spent over $8 TRILLION in the last 34 months.

The end result is that inflation has arrived in the financial system. And the Fed CANNOT try to “cushion” this situation because more money printing/ easing is only going to make things worse.

Put another way, this crisis is going to take longer, and get much worse than anyone expects. It’s quite possible stocks don’t bottom until 2024… at levels most investors can’t even imagine.

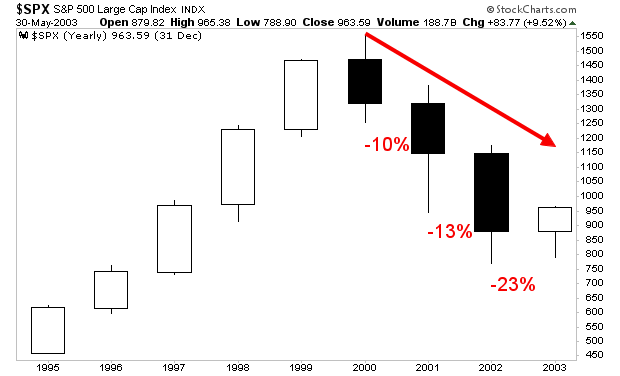

The time to prepare for this is NOW. During the bear market of 2000-2003, things actually got worse each successive year with stocks losing 10% in 2000, 13% in 2001, and 23% in 2002.

I believe something similar will happen this time around

If you’ve yet to take steps to prepare for this crisis, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM.html