By Graham Summers, MBA

Investors should be praying for a stock market crash.

From a systemic perspective, the markets have entered a period of “risk off”. This has been the case since March of 2022. And the single best thing for investors would be for the markets to get this situation over with quickly via a crash.

Yes, I am fully aware that crashes are extremely painful and involve investors losing a lot of money. However, when the markets crash, they also bottom quickly, which means the pain is over FAST.

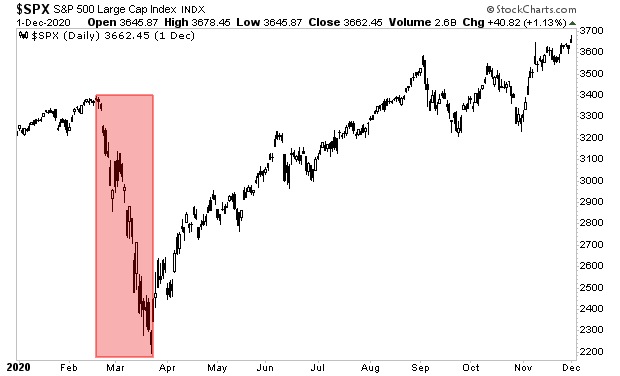

Consider the 2020 Crash: the entire collapse was over in about five weeks. And stocks had already begun to recover much of their losses within a few months. In fact, within six months they were at new all-time highs!

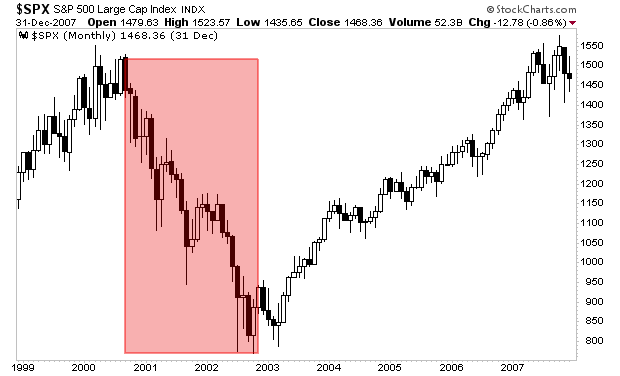

Now compare that to the Bear Market of 2000-2002.

That collapse took over TWO YEARS to complete. Not months… YEARS. Peak to trough the S&P 500 lost 50%. And on a yearly basis the losses were actually worse with each successive year. The market lost 10% in 2000, 13% in 2001, and 23% in 2002.

Worst of all, it took the S&P 500 FIVE years to recoup its losses. Investors lost money for years and then had to wait half a decade to make those losses back.

So again, the best thing for investors would be for the markets to crash soon. A crash would mean the pain would be over quickly and stocks could bottom.

Unfortunately, I don’t think that is going to be the case.

I’ll explain why in tomorrow’s article… however, in the meantime if you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM.html