By Graham Summers, MBA

The stock market is primed for another major leg down.

Why?

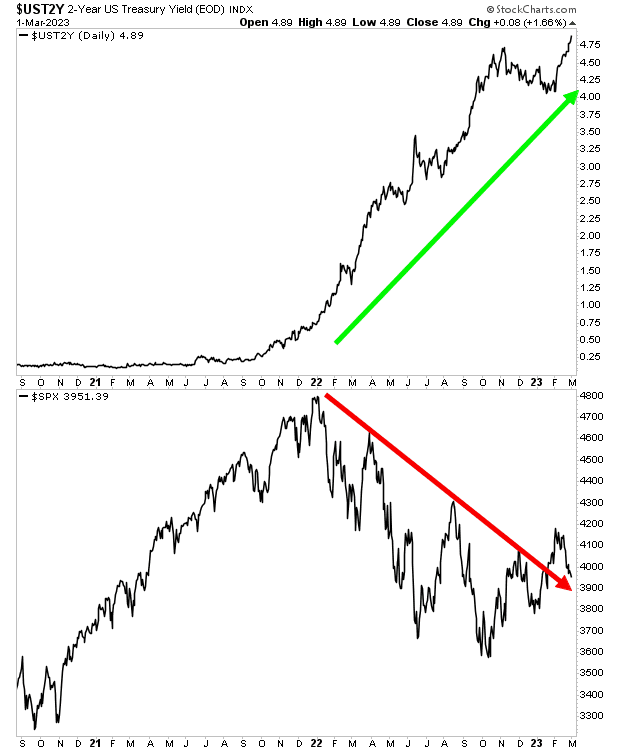

Treasury yields are spiking again.

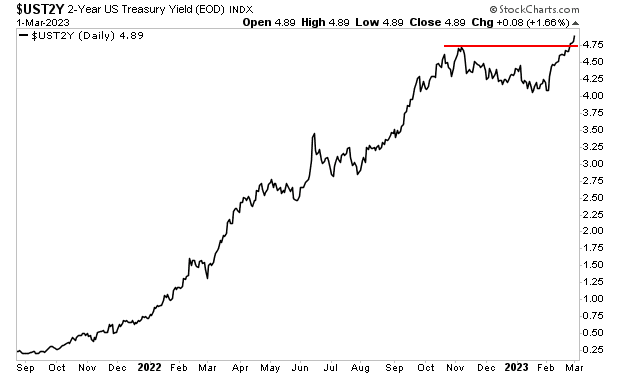

The yield on the 2-Year U.S. Treasury has exploded higher… blasting through its previous high of 4.72%. It is now closing in on 5%.

Bear in mind, it was just 1.25% this time last year.

Why does this matter?

The ENTIRE collapse in stocks thus far in this bear market has been due to Treasury yields spiking. Investors used to collect 0.25% “risk free” from these bonds. They can now get almost 5%.

As a result of this, no one is willing to pay 20-22 times forward earnings for growth from stocks. Instead they’re paying just 16-18 times forward earnings. And by the look of things it will soon be lower than that. Treasury yields keep rising… so stocks will keep falling.

This is the kind of environment in which crashes can happen. The Fed is rapidly losing credibility. And investors have been suckered into believing the “worst” is behind them: they poured $1.5 billion into stocks every day in January. And they did this at a time when my proprietary Crash Trigger is now on the first confirmed “Sell” signal since 2008.

This signal has only registered THREE times in the last 25 years: in 2000, 2008 and today.

If you’ve yet to take steps to prepare for what’s coming, we have published an exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth.

This report is usually $250, but we’re giving away 100 copies for FREE to those who sign up for our free daily market commentary.

To pick up one of the remaining copies, use the link below…

https://phoenixcapitalmarketing.com/BM2.html