By Graham Summers, MBA

Tech is finished.

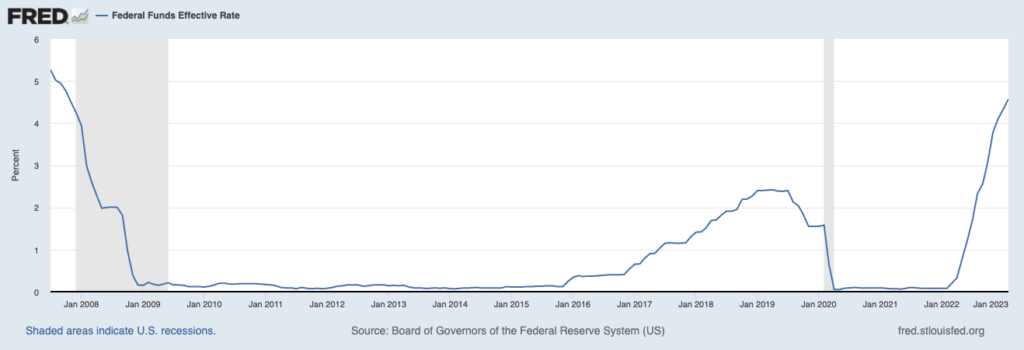

Ever since the Great Financial Crisis of 2008, the Fed has been primarily in an accommodative framework. For most of 2008-2023, interest rates were at ZERO or 0.25%. The below chart shows where rates were from 2007 until today. You’ll see that with the exception of 2017 to mid-2019, rates were effectively at ZERO for most of this time.

The Fed didn’t just keep rates at zero either. It printed money and used that money to buy assets/ debt securities to prop up the system anytime things started to break down.

We’re not talking about a little money printing either. Between 2007 and 2023, the Fed printed over $8 TRILLION.

This suppression of interest rates… combined with the money printing and easy access to credit had one primary beneficiary…

The Tech sector.

Tech, particularly high beta garbage Tech (apps, texting companies, social media, etc), NEEDs low interest rates to even exist because these companies require a TON of capital/ debt to reach profitability (assuming they even do that, which 95% DON’T).

And remember, we’re not talking about the Fed creating an artificial environment for a few months. They’ve been doing it for most of 15 years. And every time the system began to break down, the Fed would do even MORE extreme versions of these policies… which in turn made the environment even more favorable to the Tech industry.

How bad did this get?

Talk to anyone who wants to become an entrepreneur today and he or she will say they want to found a Tech company. NO ONE says they want to go into energy, or materials, or manufacturing. It’s all about apps, social media, search engines, etc.

Think of it this way, as of 2021…

The largest automaker in the stock market was a tech stock (Tesla).

The largest commerce company in the stock market was a tech stock (Amazon).

The largest consumer discretionary company in the stock market was a tech stock (Apple).

And so on…

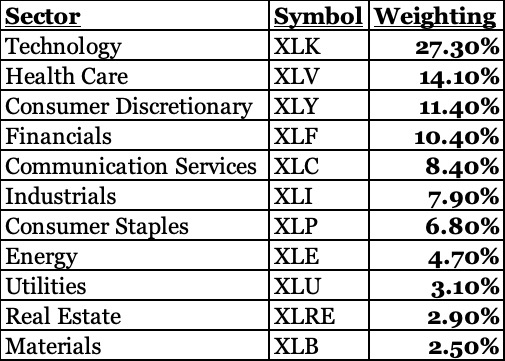

The Tech sector was the largest sector by weighting in the S&P 500 by almost a factor of two. In fact, Tech was larger than both the 2nd and the 3rd heaviest weighted sectors COMBINED!

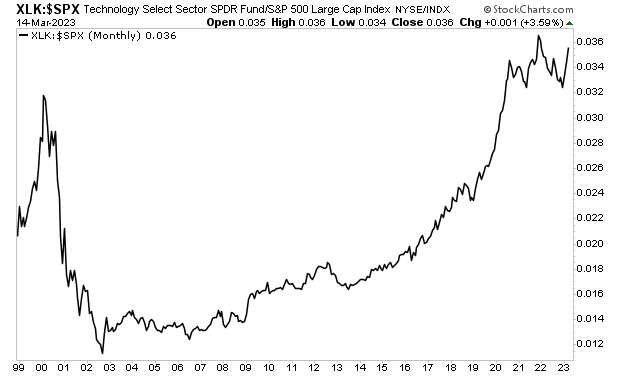

The below chart shows the performance of the Tech Sector relative to the broader market (S&P 500 since 1999). As you can see, Tech outperformed the broader market non-stop from 2008 onward. By the time 2022 rolled around, it was at levels that EXCEEDED those established by the Tech Bubble of 2000!

All of this is due to the Fed.

Most of the people who work in Tech are not geniuses, nor are they the best entrepreneurs on the planet. They were simply the beneficiaries of an artificial environment created by the Fed.

In the simplest of terms, Tech is to the bubble today, what Banks were to the bubble in 2007: the sector that benefited most, generated the largest profits, and consumed the largest percentage of talent/ aspirations.

That period is now OVER. And it’s not coming back.

So what does this mean for the markets?

Well, if the largest sector in the market is in a spectacular bubble the likes of which won’t return for at least another decade… what do you think?

The Silicon Valley Bank bailout is the Bear Stearns moment for this bubble. Lehman is coming… as is AIG… and this entire mess won’t end until the stock market hits levels most cannot even imagine today.

Indeed, from a BIG PICTURE perspective my proprietary Crash Trigger is now on the first confirmed “Sell” signal since 2008.

This signal has only registered THREE times in the last 25 years: in 2000, 2008 and today.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM.html