By Graham Summers, MBA

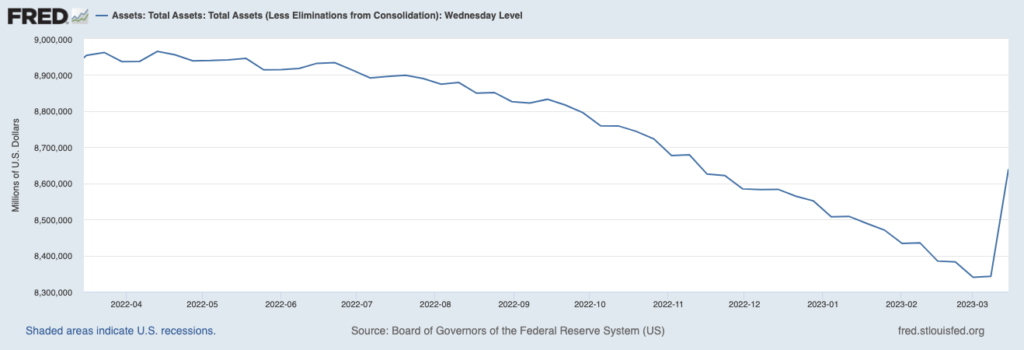

The Fed just gave out over $300 BILLION in single week.

See for yourself: the Fed’s balance sheet has erupted higher, erasing over HALF of its Quantitative Tightening (QT) efforts. Again, we are talking about $300+ BILLION in a single week.

Now, technically much of this ($164 billion to be exact) came in the form of loans to banks. The banks will have to pay this back, so it’s not quite the same as Quantitative Easing (QE). Regardless, the key point is that the Fed is NO LONGER shrinking its balance sheet… instead it is printing money. And not a little bit, but $300+ billion in a single week.

To put that into perspective, it’s the equivalent of more than TWO MONTHS’ worth the Fed’s emergency QE program that it ran in response to the pandemic. And again, the Fed did this in just FIVE DAYS.

What does this mean?

First and foremost, that something VERY BAD is going on behind the scenes in the U.S. banking system. But more importantly for us as investors, that the next round of bailouts/ easing/ reflating the financial system is here.

This won’t end well.

The Silicon Valley Bank bailout is the Bear Stearns moment for this bubble. Lehman is coming… as is AIG… and this entire mess won’t end until the stock market hits levels most cannot even imagine today… to the downside

Indeed, from a BIG PICTURE perspective my proprietary Crash Trigger is now on the first confirmed “Sell” signal since 2008.

This signal has only registered THREE times in the last 25 years: in 2000, 2008 and today.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM.html