By Graham Summers, MBA

Stocks are rallying today because they believe:

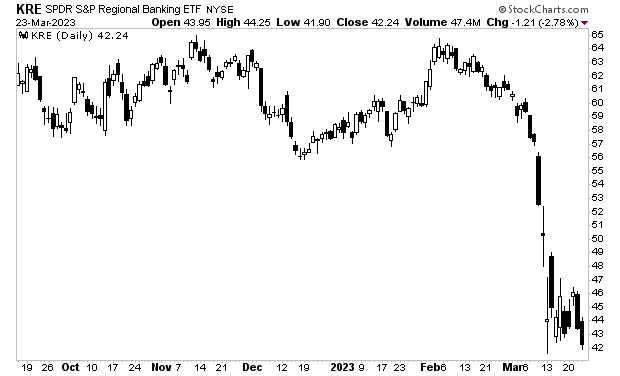

1) The bank crisis is over (it isn’t).

2) The Fed is back to easing (it isn’t).

3) The economy is strong (it isn’t).

4) The Fed can achieve a “soft landing” (it can’t).

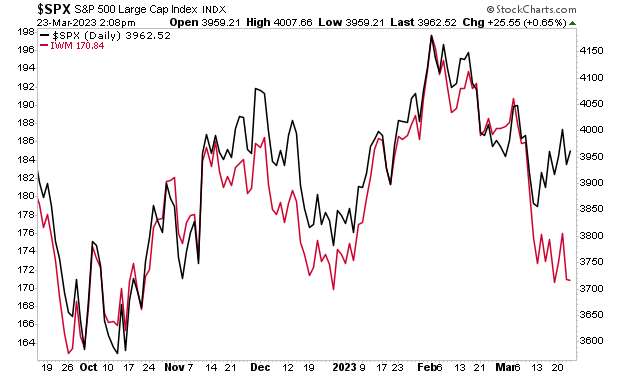

The Russell 2000 (IWM) which is more closely aligned with the economy and growth has figured this out. It’s only a matter of time before the S&P 500 “gets it.”

Meanwhile, regional banks are back at the lows.

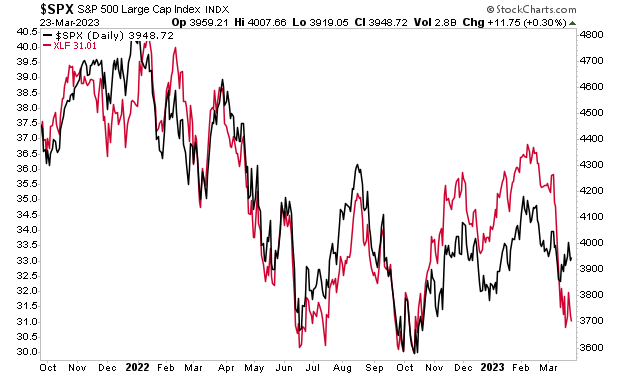

Financials usually lead the broader market. Maybe this time is different?

Or maybe the next leg down is coming and coming soon.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM2.html