By Graham Summers, MBA

Now is the time to be particularly careful in the markets.

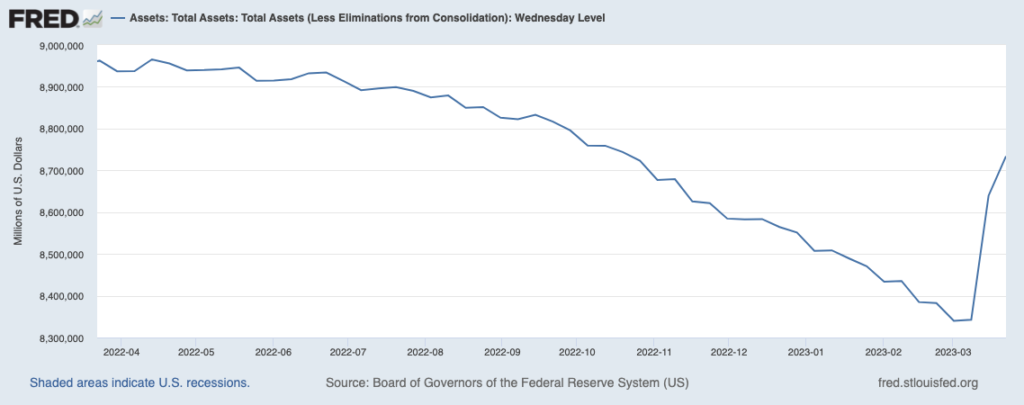

First and foremost, the banking crisis is not over. This is quite concerning, because the Fed has pumped nearly $400 BILLION into the financial system in the last two weeks.

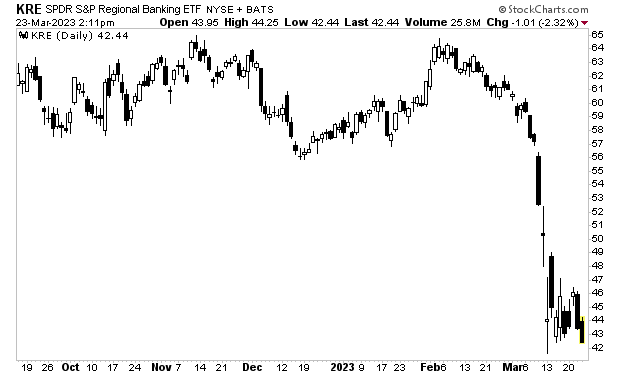

Despite these emergency loans/ access to credit, the regional banking ETF is right back near its panic lows. What does it say about the issues in the financial system that $400 billion in additional liquidity combined with verbal backstops by the Fed/ Treasury isn’t enough to reverse the decline?

The next leg down is coming and coming soon.

Indeed, from a BIG PICTURE perspective my proprietary Crash Trigger is now on the first confirmed “Sell” signal since 2008.

This signal has only registered THREE times in the last 25 years: in 2000, 2008 and today.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM2.html

PS. Our new investing podcast Bulls, Bears & BS is officially live and available on every major podcast application (Apple, Spotify, etc.)

To download or listen, swing by:

https://bullsbearsandbs.buzzsprout.com/