By Graham Summers, MBA

Something doesn’t add up.

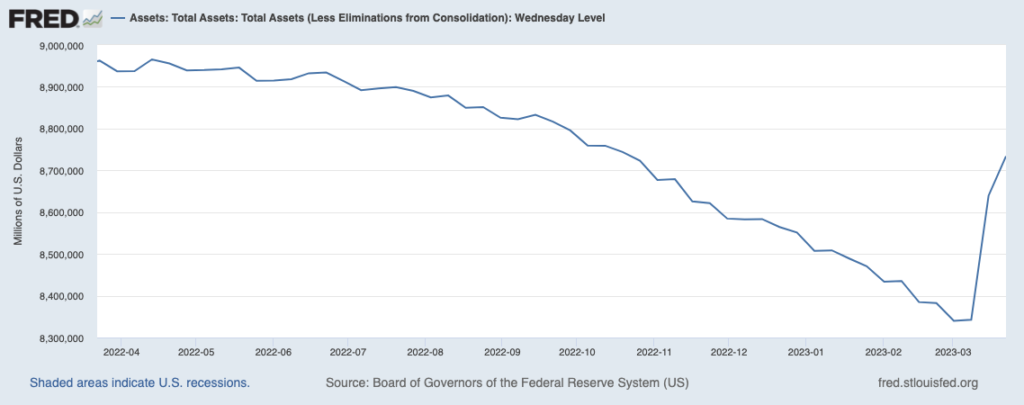

The Fed and Treasury keep telling us everything is fine… but the Fed has just expanded its balance sheet by $400+ billion in the span of two weeks.

We haven’t seen money printing like this since the depth of the 2020 meltdown. The Fed has erased 2/3rds of its 9 month long Quantitative Tightening in 14 days!

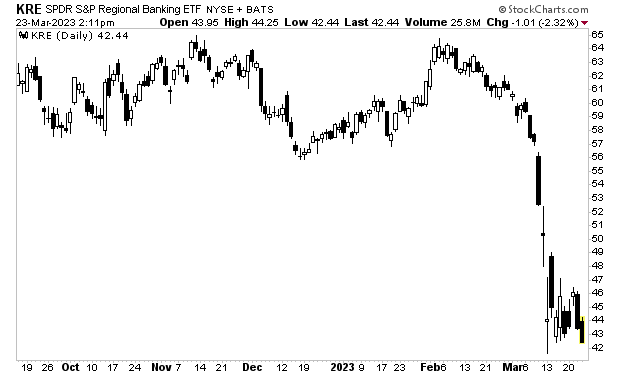

Despite these emergency loans/ access to credit, the regional banking ETF is right back near its panic lows.

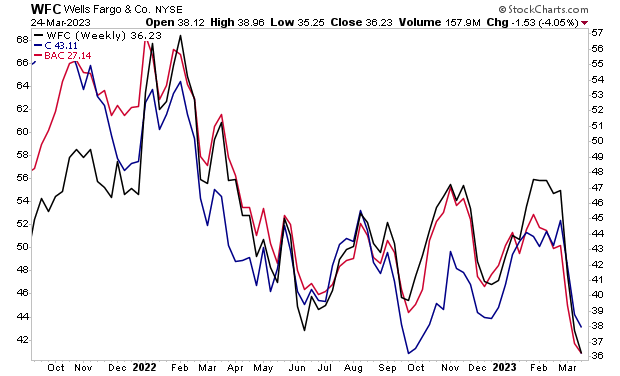

Even stranger, several of the big banks are collapsing in share price as well. Wells Fargo, Bank of America, and Citigroup are all back at their October lows.

Looking at this, it appears something MAJOR is brewing behind the scenes. Banks might less than 14% of the S&P 500 weighting, but they account for something like 70% of all mortgages and 60% of all consumer loans.

Put simply, if this sector is in major trouble, it’s going to have a MAJOR effect on the economy.

Indeed, from a BIG PICTURE perspective my proprietary Crash Trigger is now on the first confirmed “Sell” signal since 2008.

This signal has only registered THREE times in the last 25 years: in 2000, 2008 and today.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM2.html

PS. Our new investing podcast Bulls, Bears & BS is officially live and available on every major podcast application (Apple, Spotify, etc.)

To download or listen, swing by: