By Graham Summers, MBA

A few charts to consider…

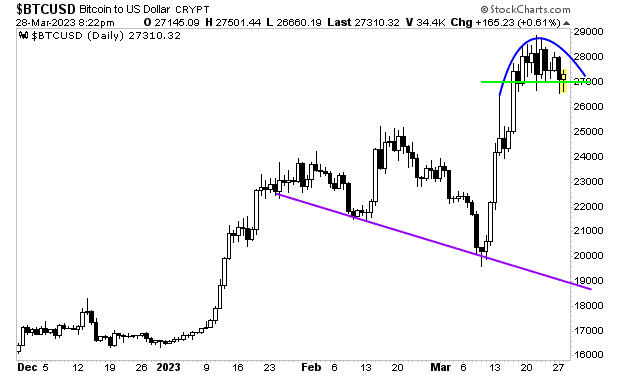

Bitcoin… the ultimate liquidity play, has a rounded top. It is just clinging to support. Below that is nothing but air pockets down to 24,000 it not 19,000.

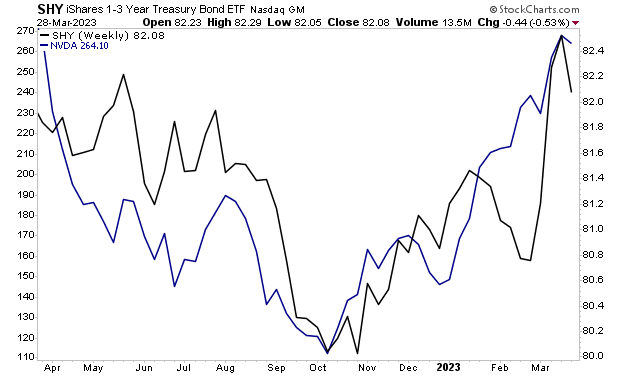

Short term Treasury bonds and high beta growth company Nvidia (NVDA). This entire move higher in high growth tech has been driven by rates. That is now ending…

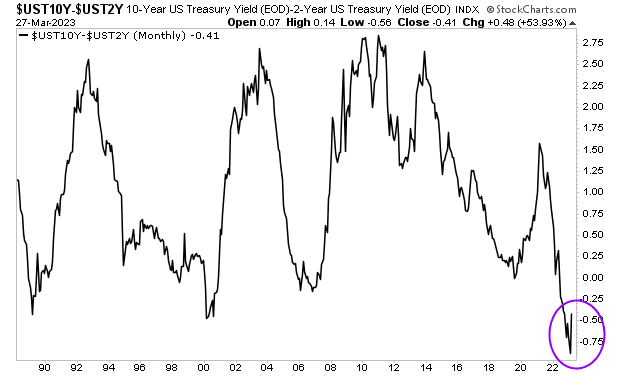

Historically a recession hits when a yield curve inversion goes back to positive. We’re well on our way to that as I write this.

Seeing multiple set ups suggesting the same thing (a risk off move is coming) adds to the probability. And from a BIG PICTURE perspective my proprietary Crash Trigger is now on the first confirmed “Sell” signal since 2008.

This signal has only registered THREE times in the last 25 years: in 2000, 2008 and today.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM2.html

PS. Our new investing podcast Bulls, Bears & BS is officially live and available on every major podcast application (Apple, Spotify, etc.)

To download or listen, swing by:

https://bullsbearsandbs.buzzsprout.com/