By Graham Summers, MBA

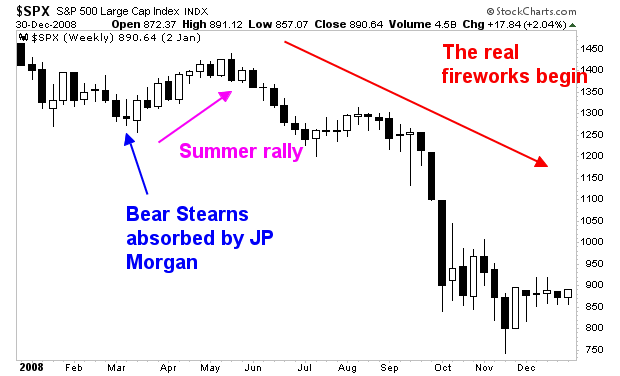

Investors are running a repeat of the same trading pattern we saw in 2008.

That pattern?

A mini-crisis in March, followed by a summer rally, and then the real fireworks begin.

In 2008, Bear Stearns had to be absorbed in a shotgun wedding to JP Morgan on March 16th. That marked a temporary low, as investors believed the Fed easing/ backstopping the issue resolved things despite the clear evidence that the economy was rolling over.

The stock market then rallied for two months before the crisis began in earnest.

Today in 2023, the same pattern is playing out.

Once again, there was a mini-crisis in March with Silicon Valley Bank/ Signature Bank playing the part of Bear Stearns. The Fed / Treasury stepped in, backstopping the troubled banks and facilitating a deal to have them absorbed by other players.

Investors are taking this to signal the “all clear” and are piling back into stocks, kicking off a rally… once again despite the clear evidence the economy is rolling over.

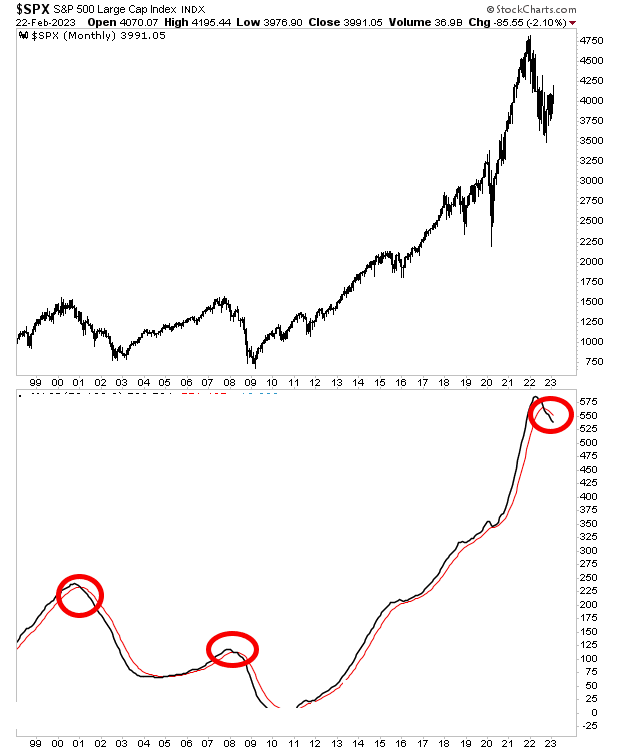

As if this wasn’t spooky enough, consider that in the BIG PICTURE my proprietary Crash Trigger is now on the first confirmed “Sell” signal in over a decade.

The last time this signal hit?

2008.

See for yourself…

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM2.html

PS. Our new investing podcast Bulls, Bears & BS is officially live and available on every major podcast application (Apple, Spotify, etc.)

To download or listen, swing by:

https://bullsbearsandbs.buzzsprout.com/