By Graham Summers, MBA

The Fed has turned off the money pump again.

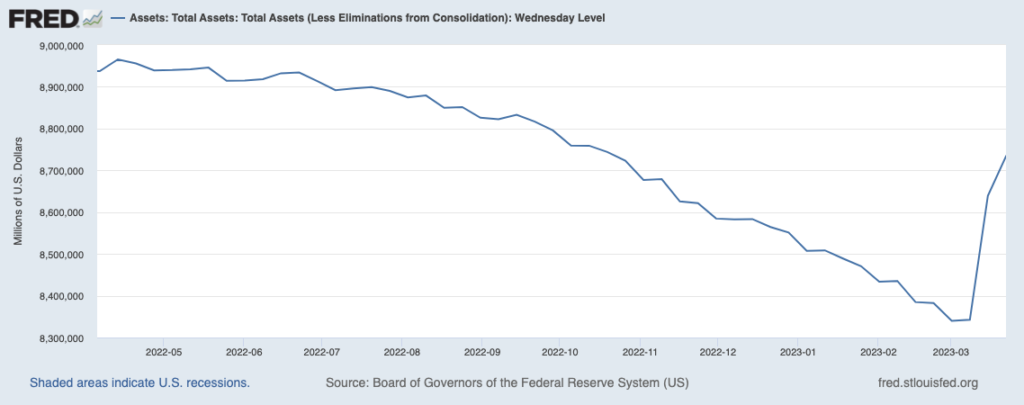

If you’re looking for a reason why stocks erupted higher starting in early March, look no further than the below chart of the Fed’s balance sheet. As you can see, during the regional banking crisis triggered by the collapse of Silicon Valley Bank, the Fed began expanding its balance sheet rapidly.

How rapidly?

Nearly $400 BILLION in two weeks’ time. Not since the depths of the 2020 crash has the Fed printed this much money.

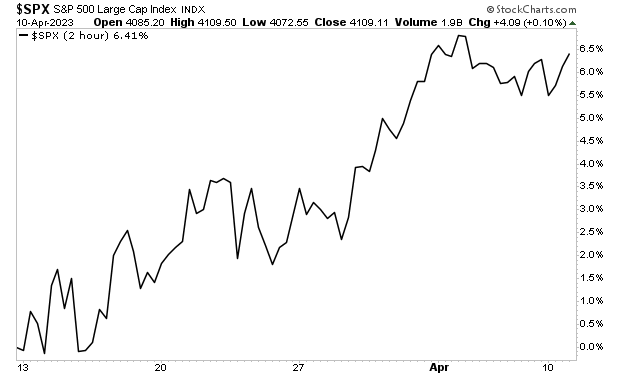

Stocks bottomed soon after this… exploding higher by 6+% in a single month.

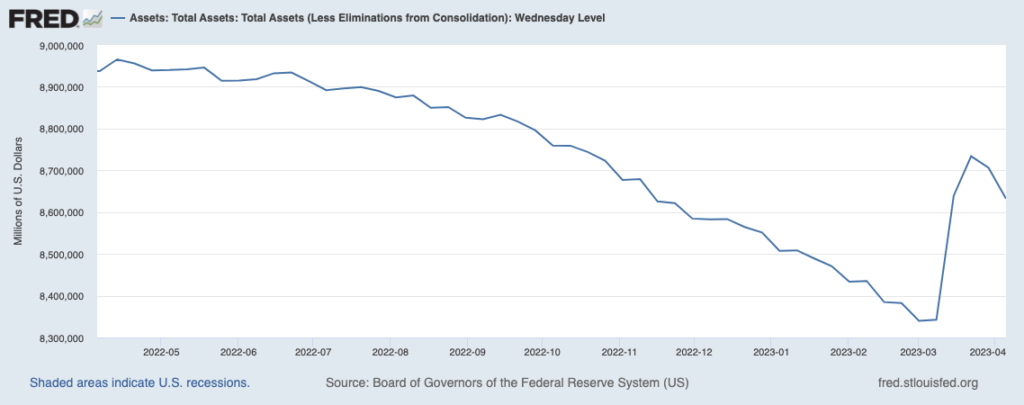

I bring all of this up, because the Fed has turned off the money printer again. Over the last week, the Fed’s balance sheet has fallen by $100 billion.

What does this mean?

The clock is ticking for stocks. And with a recession just around the corner… it’s only a matter of time before the market breaks to new lows.

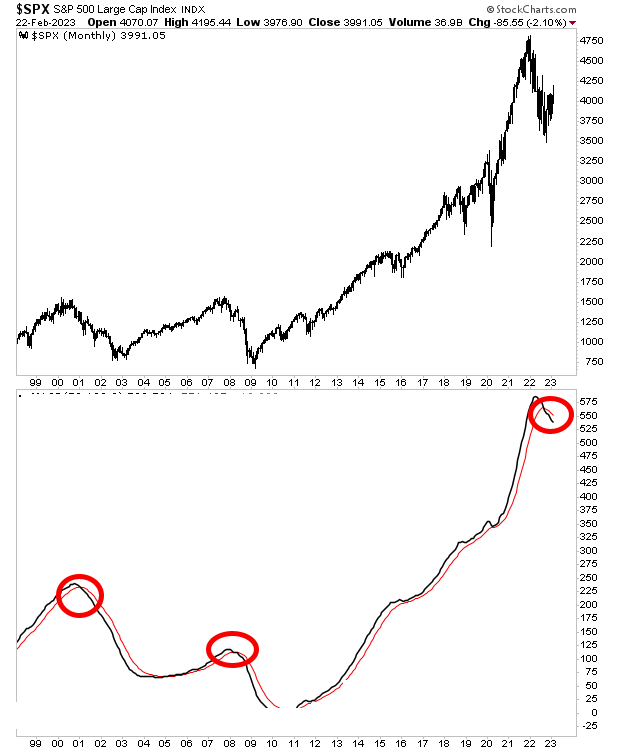

Indeed, our proprietary Crash signal has just triggered its 3rd confirmed signal in the last 25 years. The last two times it signaled?

2000 and 2008.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM2.html

PS. Our new investing podcast Bulls, Bears & BS is officially live and available on every major podcast application (Apple, Spotify, etc.)

To download or listen, swing by: