By Graham Summers, MBA

It’s earnings season and options expiration week for the month of April.

Both of those items have historically been extremely bullish: stocks almost always rally into earnings and options expiration week is the week of for Wall Street to gun the markets higher.

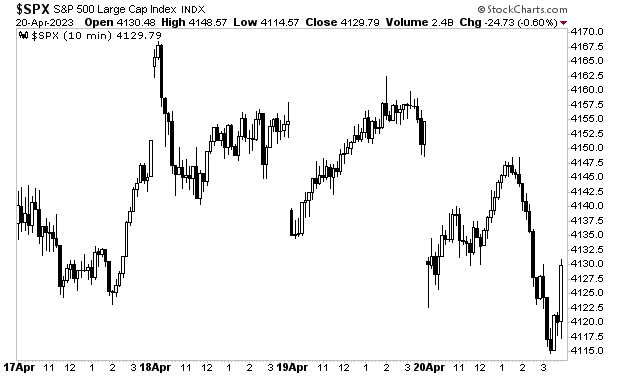

And yet… the stock market is doing this.

When a pattern that has a lot of historical precedent stops working… it can indicate a serious shift is taking place under the surface of the markets.

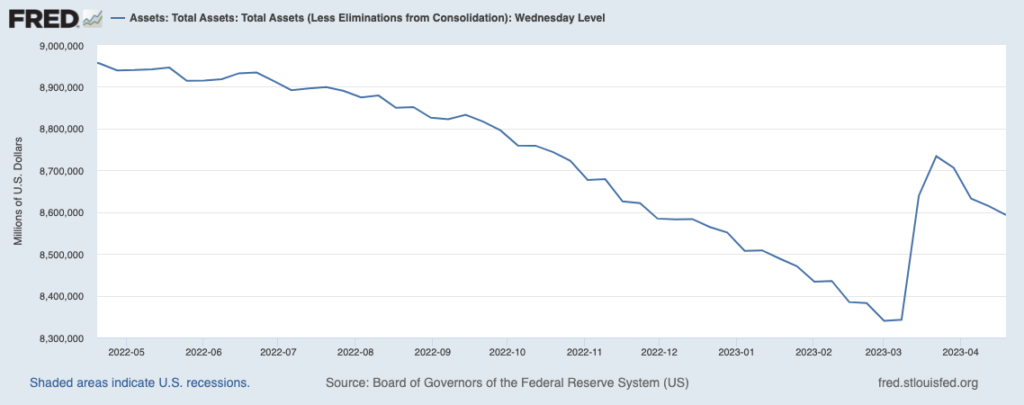

I would also note that the Fed’s balance sheet has rolled over, indicating that the Fed is withdrawing liquidity from the system again.

While Bitcoin and other liquidity plays are beginning to roll over as well.

All of this suggests the next leg down for the markets is just around the corner.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

We made just 100 copies available to the general public.

As I write this, there are less than 50 left.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM2.html

PS. Our new investing podcast Bulls, Bears & BS is officially live and available on every major podcast application (Apple, Spotify, etc.)

To download or listen, swing by: