By Graham Summers, MBA

Dear Investor,

You no doubt have some concerns about the bank at which you keep your deposits.

I mean, why wouldn’t you? Three of the largest bank failures in U.S. history have already taken place this year. And by the look of things, there are even more to come.

So today we’re going to do a quick break down of how to analyze a bank to see if it’s in trouble. This is NOT meant to be an exhaustive lesson on accounting, but simply a decent rule of thumb to help you figure out if a bank is in serious trouble as far as its bond portfolio is concerned.

As I’ve already outlined earlier this week, 2022 was the worst year on record for long-term Treasury bonds. This has been a huge problem for banks which own hundreds of billions, if not trillions of dollars’ worth of long-duration bonds and loans that move based on what happened with Treasuries. Unless the banks hedged this risk, they are likely sitting on substantial losses in their long-duration portfolios.

Now, by law, every bank has to report the losses or gains on many of the assets it owns. These are recorded as “unrealized” gains or losses in the case of the assets that the bank still owns/ has yet to sell.

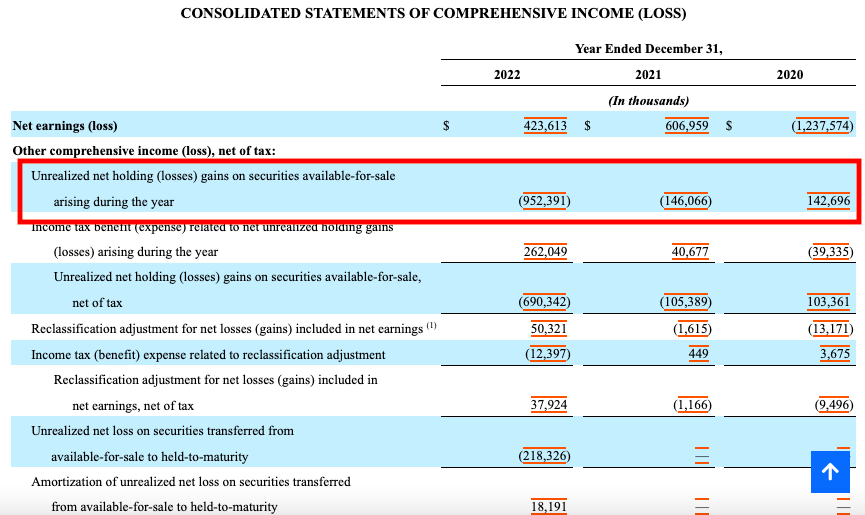

See for yourself.

Below is a screenshot from the income statement of a bank. As you can see, the total amount of unrealized losses ballooned in 2022, likely as a result of these assets dropping in value when the bond market collapsed. As of year-end 2022, this bank is sitting on $952 million worth of unrealized losses.

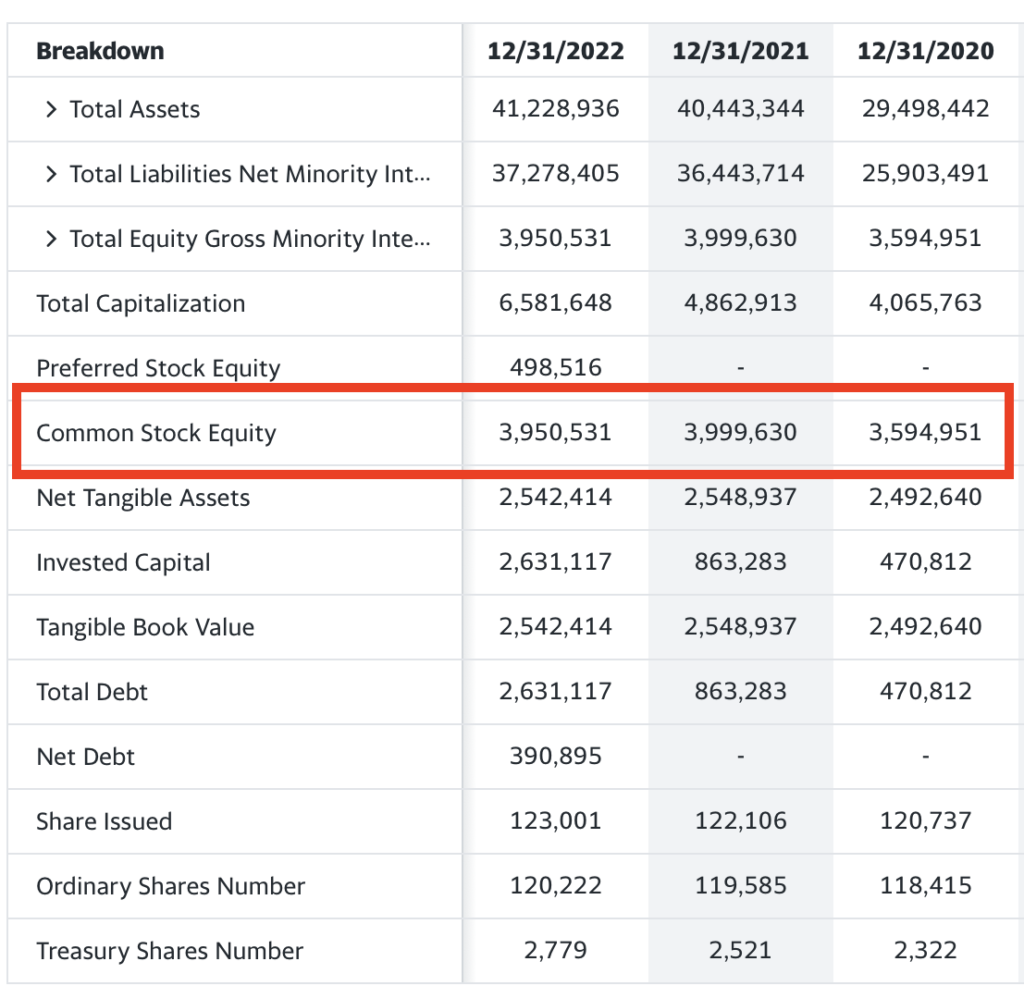

Now, that sounds like a lot of money in “unrealized losses,” but everything is relative. So to see if this is a major issue we need to assess that number against the bank’s shareholder equity (the stock owners).

In this particular instance, the bank in question has shareholder equity of $3.9 billion. So put another way, this bank is sitting on unrealized losses equal to 25% of shareholder equity. That’s a pretty big deal, which would suggest this bank could find itself in trouble.

All of this information can be found on the SEC’s website. Simply go there, type in the symbol for your bank, then go to its annual or quarterly financial statements (the 10-K or 10-Q). You can even do a “search” function in those files for the terms “unrealized losses” or “shareholder equity” to find the specific parts you need to see.

I hope this helps!

If you’ve yet to take steps to prepare for what’s coming courtesy of the banking crisis, we have published an exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth.

This report is usually $250, but we’re giving away 100 copies for FREE to those who sign up for our free daily market commentary.

Today is the last day this report is available to the general public.

To pick up one of the remaining copies, use the link below…

https://phoenixcapitalmarketing.com/BM2.html