By Graham Summers, MBA

One of the biggest questions we hear from clients is “why aren’t stocks breaking down?”

The answer is simple: the government.

The Fed is fighting inflation. The government is NOT. The Fed is raising interest rates and engaging in Quantitative Tightening (QT). The government is running a $1+ trillion deficit. And this is in spite of a record tax haul.

In our current socialist version of America, this money is being funneled into the economy. And as a result of this, the economy continues to plod along despite inflation hanging around 5%.

It’s likely going to get worse from here.

Estimated federal outlays for 2023 are slated to be $6.3 TRILLION. That’s 23% of GDP. and the Debt Deal only increases this as it will remove ALL SPENDING CAPS for the Federal Government through 2025.

Uncle Sam isn’t the only one spending like there’s no tomorrow.

State, county and local governments are all spending loads of money. The 50 U.S. states have budgets of $1.2 trillion for FY 2023. That’s a 6.7% increase over that of 2022 which was an 18% increase over 2021. And by the way, that 18% increase in 2021 was the largest in history.

So… if you’re looking for a reason why the economy refuses to roll over… and why stocks continue to hold up… here’s your answer: because the U.S. government from the federal down to the local level is spending trillions and trillions of dollars.

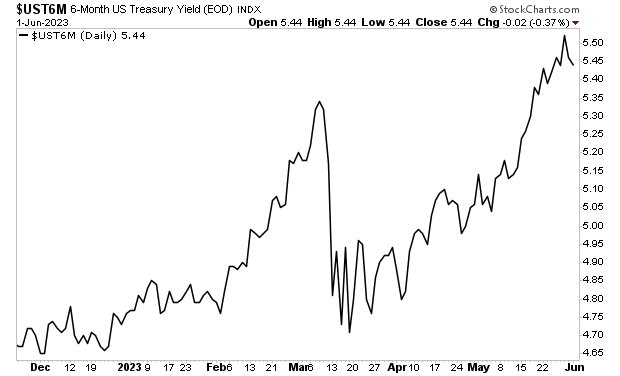

All of this is HIGHLY inflationary. And the bond market knows it.

The yield on the 6-month U.S. Treasury recently hit new highs for this cycle. The impact this is going to have on every asset class will be profound.

On that note, we published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.Paragraph

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm2.html

Best Regards,