By Graham Summers, MBA

There are two primary reasons why inflation has remained so persistent despite the Fed raising rates from 0.25% to 5.25% in the span of 14 months.

1) The Fed is using the wrong tools to end inflation.

2) The Federal Government continues COVID-19 emergency levels of spending.

Yesterday we discussed #1. Today we’re going to dissect #2.

Between 2020 and 2022, the Fed printed roughly $5 trillion. The Federal Government spent/ printed another $6 trillion.

Over the last 14 months, Fed has raised rated from 0.25% to 5.25% while draining $500 billion in liquidity from the financial system. In simple terms, the Fed has stopped printing money and is tightening monetary policy.

The Federal Government has not altered its money printing/ spending. In fact, courtesy of the Debt Deal that was just signed into law, the Federal Government has NORMALIZED the emergency levels of stimulus/ spending it introduced during the pandemic.

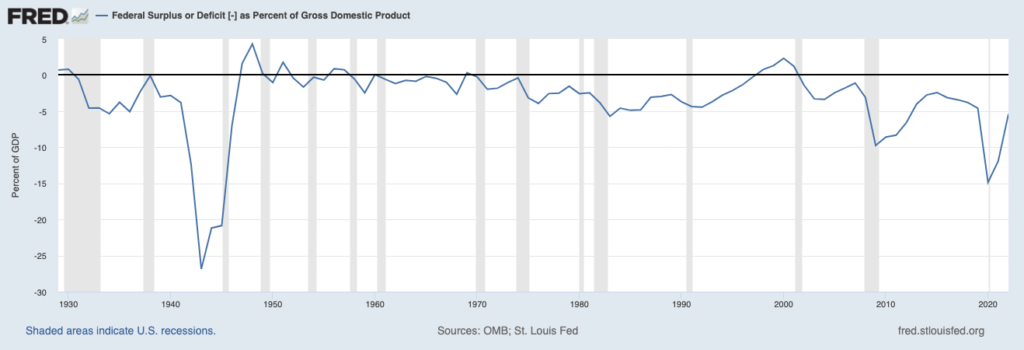

The government is financed via tax revenues. If spending is greater than tax revenues, then the government issues debt to finance its spending. Despite pulling in record taxes in 2021 (and 2022’s tax haul is looking to be ever greater), the U.S. continues to run $1+ trillion deficits.

Relative to GDP, the deficit is greater than that the government ran during the depths of the 2008 crisis. Indeed, you have to go back to World War II to find a period in which the deficit relative to GDP was greater! And bear in mind, the government is currently running this kind of deficit TWO YEARS after the recession associated with the shutdowns ended!

And thanks to the Debt Deal, this level of stimulus/ spending will become normalized.

Section 265 of the bill notes that the OMB (Office of Management and Budget) director has sole waiver authority to spend whatever money the government wishes if said spending is deemed “necessary for program delivery.” (H/T. Rep Nance Mace for catching this).

The OMB is the part of the Executive Branch in charge of “overseeing the implementation” of the President’s “vision” for the economy. The OMB director is appointed by the President. And according to the current version of the debt dealing congress is voting on, this person has “sole waiver” authority on spending caps.

Put simply, she (the current OMB director is Shalanda Young), is permitted to spend as much money as President Biden wants, provided the spending is deemed “necessary” to deliver on programs that meet his vision for the economy.

That single line negates any and all cuts or spending caps laid out elsewhere in the debt deal. It’s akin to someone writing “everything else in this 99-page bill is non-binding.”

In the very simplest of terms, this deal, if it passes, would normalize the government’s COVID-19 level of spending. This would be highly inflationary. And it would make the Fed’s job of tackling inflation that much more difficult.

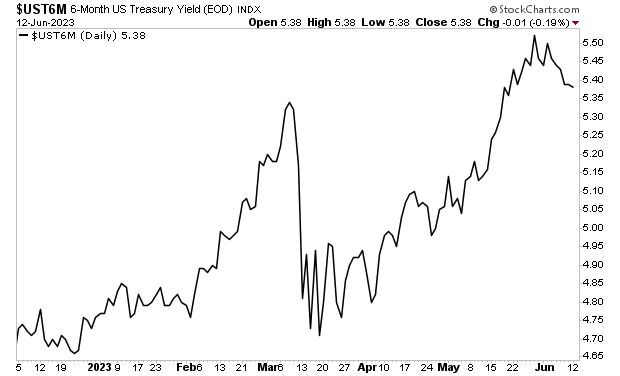

This is why the yield on the 6-month U.S. Treasury bill has soared to new highs…

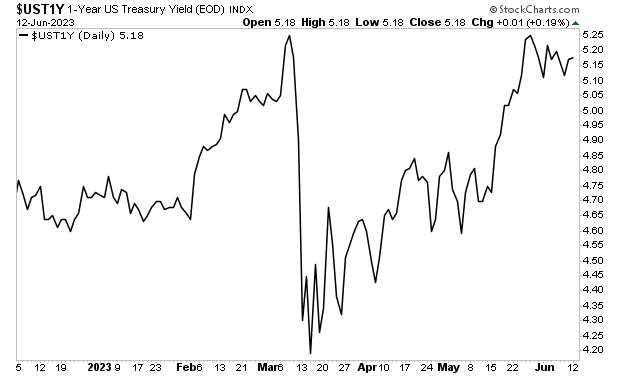

While the yield on the 1-Year U.S. Treasury is back at its former highs.

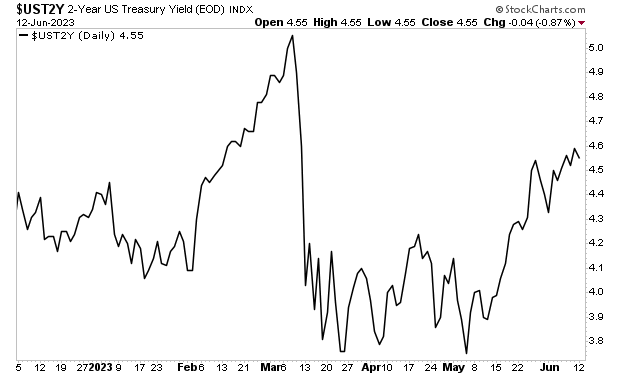

The above charts tell us the bond market is figuring out the Fed will need to raise rates higher and hold them there for much, MUCH longer. Three months ago, the Treasury market thought rates would be at 3.75% in two years. It is now suggesting rates will be 4.50% two years from now.

Anyone who believes the Fed will be easing monetary policy soon is mistaken. Between the Fed’s refusal to drain excess liquidity from the financial system and the Debt Deal normalizing the federal government’s pandemic levels of spending, inflation is going to become quite sticky, if not permanently embedded in the financial system.

There are many different ways to profit from this situation. We recently outlined a unique “of the radar” one favored by a family of billionaires in an investment report called Billionaire’s “Green Gold.”

Normally this report would be sold for $249. But we are making it FREE to anyone who joins our Daily Market Commentary Gains Pains & Capital.

To pick up your copy, swing by:

https://phoenixcapitalmarketing.com/GreenGold.html