By Graham Summers, MBA

Last week I outlined a major development in the currency markets.

That development?

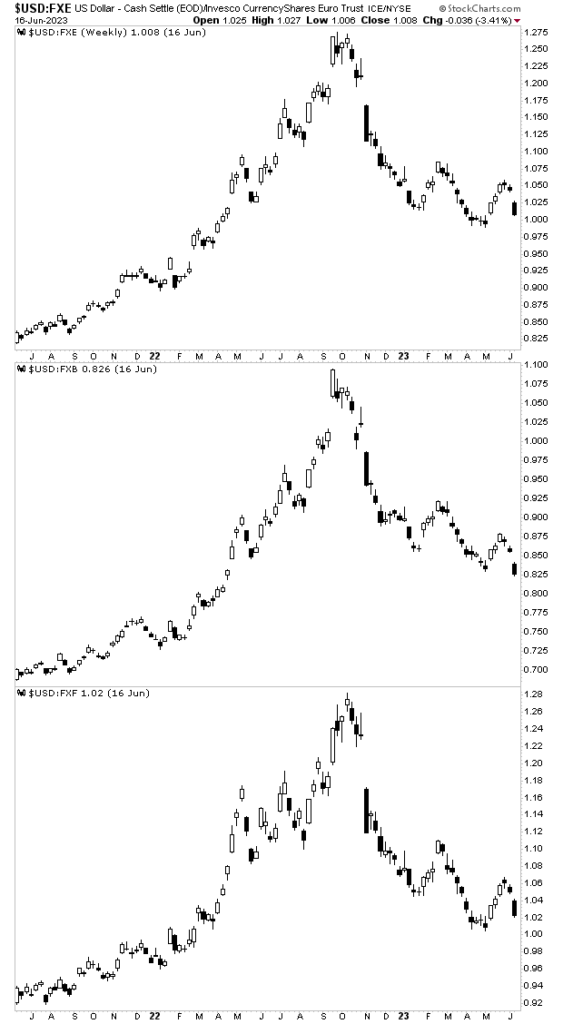

That the U.S. dollar has begun to decline against nearly every major currency (the Euro, Pound, and the Franc). The U.S. dollar peaked in October 2022 against ALL of these currencies. It has since entered a steep decline, losing ~20% of its value against each of these currencies.

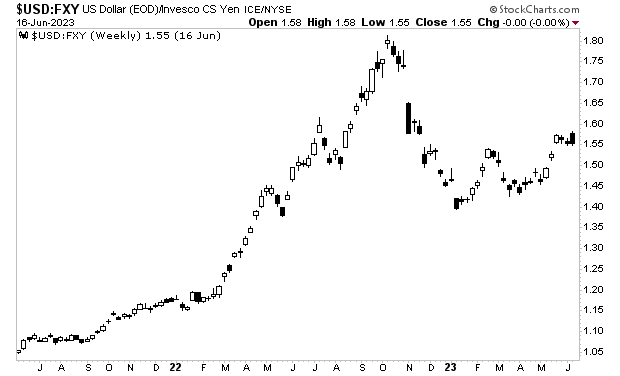

Indeed, the only currency against which the $USD has demonstrated any strength is the Yen… and that’s only in the last few months as it became clear that the Bank of Japan would continue to printing money/ maintaining its easy monetary policies. But even then, the U.S. dollar is still significantly lower in value from its prior peak.

What is happening here?

From a fundamental perspective, the $USD should be stronger than these other currencies. For one thing, interest rates are higher on the $USD (5.25% vs. 3.% for the Euro, 5% for the Pound and 1.75% for the Franc).

Moreover, the U.S. central bank, the Federal Reserve or Fed, is supposedly farther along in its quest to end inflation than the other central banks that issue those other currencies: the Fed has just announced a skip or pause in rate hikes, while the European Central Bank, Bank of England and Swiss National Bank are still hiking rates.

So what is happening here?

Is the U.S. dollar losing its reserve currency status before our very eyes? Why is the greenback so weak when it should be quite strong?

I think I know what it happening here. And I’ll detail what in tomorrow’s commentary. In the meantime, there are many different ways to profit from this situation. We recently outlined a unique “of the radar” one favored by a family of billionaires in an investment report called Billionaire’s “Green Gold.”

Normally this report would be sold for $249. But we are making it FREE to anyone who joins our Daily Market Commentary Gains Pains & Capital.

To pick up your copy, swing by:

https://phoenixcapitalmarketing.com/GreenGold.html