By Graham Summers, MBA

Last week I noted that the U.S. is becoming an emerging market.

By quick way of review:

1) Many of the most important institutions in the U.S. now exhibit a level of corruption that is normal for banana republics. We now see these institutions doing everything from interfering in elections to arresting political opponents and more. The individuals who do this are not punished, if anything they given book deals and TV slots.

2) The U.S. no longer has a clear rule of law. Those with the correct political leanings and connections can avoid jail time for serious crimes, even treason. Meanwhile, those on the other side of the political spectrum are given lengthy sentences for minor transgressions.

3) The U.S. economy is no longer a manufacturing/ industrial leader. Decades of outsourcing have gutted the middle class resulting in the kind of wealth disparities you usually see in emerging markets. American children dream of becoming influencers or social media personalities instead of business owners or innovators.

It’s enough to make you sick.

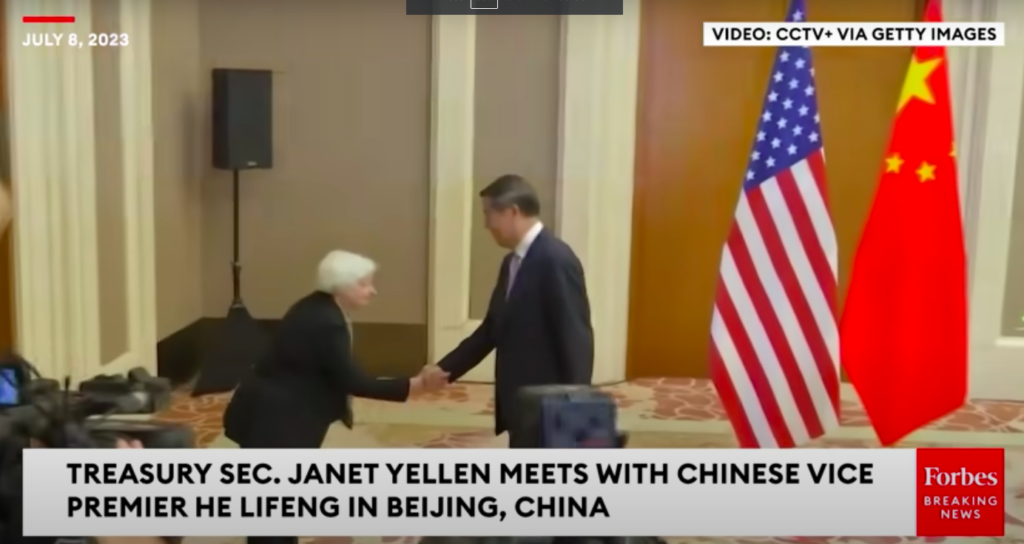

Indeed, the “U.S. is an emerging market” theme was on full display last week when our Secretary of the Treasury, Janet Yellen, arguably the most important financial figure in our country, and the person in charge of managing the U.S. dollar/ financial system, groveled in front of China’s Vice Premiere He Lifeng during her visit to China

Ms. Yellen bowed repeatedly to the Vice Premiere, groveling much as an emerging market financial official would kowtow to his or her counterpart from a more developed, superior nation upon which the former’s nation relied for aid/ support/ assistance.

See for yourself. And mind you, this is one of NUMEROUS bows.

Again, this is the thing of emerging markets. And the fact that the person who manages our finances and currency is this incompetent/ embarrassing illustrates clearly just how far the U.S. has sunk.

The only good thing that will come from this is that if you know how to invest in emerging market regimes, you can stand to make a fortune in the coming years.

Indeed, this kind of tectonic shift represents a “once in a lifetime” opportunity. Some investments are going to produce fortunes. Others will lose money for years… if not decades. And those investors who are positioned correctly for this will thrive while others struggle.

We recently outlined a unique “of the radar” investment that will outperform in this new economic landscape in an investment report called Billionaire’s “Green Gold.”

It details the actions of a family of billionaires who literally made their fortunes investing in emerging markets. And they just became involved in a mid-cap company that has the potential to TRIPLE in value in the coming months.

Normally this report would be sold for $249. But we are making it FREE to anyone who joins our Daily Market Commentary Gains Pains & Capital.

To pick up your copy, swing by:

https://phoenixcapitalmarketing.com/GreenGold.html