By Graham Summers, MBA

Everything changed for the financial system in March 2023.

What happened then?

The Fed and the Treasury implemented a backdoor bailout of the banking system.

If you’ll recall, in late February/ early March 2023, a number of smaller/ regional banks failed in the U.S. While we say these banks were “small” in comparison to the mega banks like JP Morgan or Wells Fargo, the reality is that when Silicon Valley bank, Signature Bank, and First Republic bank failed, they represented three of the largest bank failures in U.S. history.

Why were these banks failing?

Two reasons:

1) The banks were only paying 0.3% on deposits at a time when depositors could earn 4% or even 5% in a money market fund or short-term Treasuries. So people were pulling their money out of the banks in droves.

2) The banks were sitting on hundreds of billions of dollars’ worth of unrealized losses on their longer-duration assets (mid to long-term treasuries and loans) courtesy of inflation forcing these bonds to collapse.

Now, investor confidence is a strange thing. Both of the above issues were common knowledge as early as November 2022, but for whatever reason, investors chose to ignore them and give regional banks the benefit of the doubt until late February 2023,

Then Silicon Valley bank, Signature Bank, and First Republic failed, and investors began to panic, dumping regional bank shares. Banks’ share prices were falling 10%, 20% even 50% in a single day. And in early March 2023, it appeared as if the U.S. was mere days away from a full-scale banking crisis.

That’s when the Fed and the Treasury jumped in…

The Treasury, acting with the Federal Deposit Insurance Corporation (FDIC) moved to assure depositors that their money was safe, offering to backstop ALL deposits above the usual $250,000 that is insured by the FDIC.

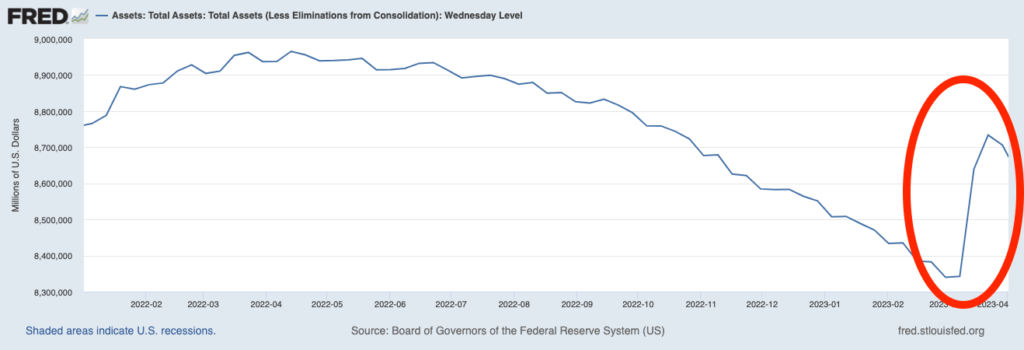

Simultaneously, the Fed pumped nearly $400 billion into the financial system in the span of three weeks.

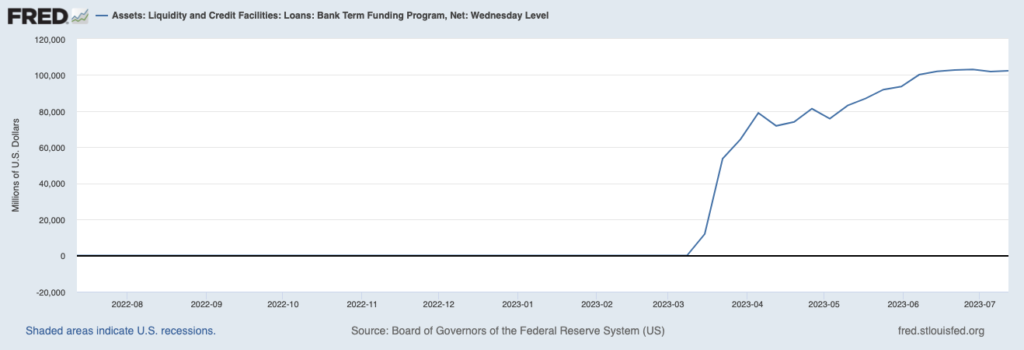

The Fed also opened a backdoor bailout scheme to funnel nearly $100 billion to the banks.

And that’s when everything changed for the stock market. Stocks bottomed and haven’t looked back.

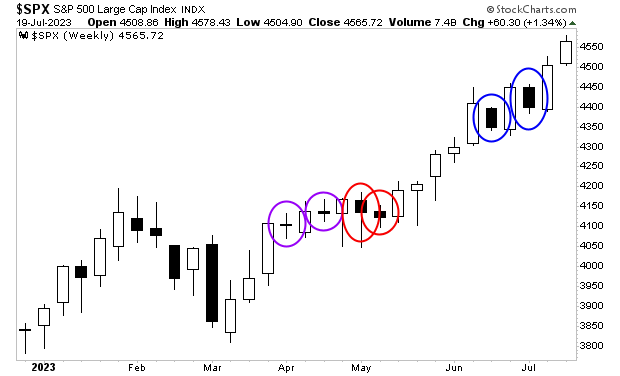

Below is a weekly chart for the S&P 500 year to date. Each of those candles represent the price action of a given week. White candles represent up weeks and black candles represent down weeks.

As you can see, the last major black candle occurred in late February/ early March 2023 during the regional banks’ issues. Since that time, the market has closed UP for 13 of the last 19 weeks. And of the six down weeks, only two were significant; the other four we all bought aggressively, with stocks reclaiming most of the initial losses by the time the week ended.

I’ve illustrated the two significant down weeks with blue circles in the chart below. Note that the other four down weeks were either down only slightly (purple circles) or saw the market ramp hard off the lows (red circles).

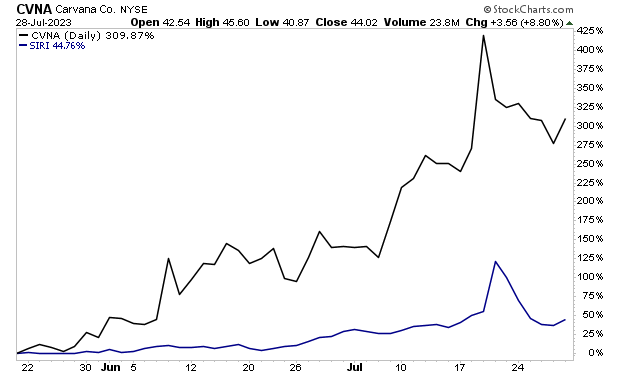

In the simplest of terms, everything changed for stocks in early March 2023. Since that time, the markets are back into “bubble mode” with everything soaring. Companies like Sirius XM Holdings have saw their share price DOUBLE in the span of a week. Meanwhile Carvana is up 700%!

Bearing all of this in mind, smart investors are asking, “what’s next? Will the Fed continue to pump the markets into an even larger bubble, or is this whole mess going to come crashing down?”

I’ll detail my thoughts on this in tomorrow’s article. In the meantime, we recently outlined a unique “of the radar” investment that will could EXPLODE higher as due to the Fed’s money printing. We detail this investment in an investment report called Billionaire’s “Green Gold.”

It details the actions of a family of billionaires who literally made their fortunes investing in inflationary assets. And they just became involved in a mid-cap company that has the potential to TRIPLE in value in the coming months.

Normally this report would be sold for $249. But we are making it FREE to anyone who joins our Daily Market Commentary Gains Pains & Capital.

To pick up your copy, swing by:

https://phoenixcapitalmarketing.com/GreenGold.html