By Graham Summers, MBA

One of the hallmarks of the Biden Presidency is that economic data is released that looks fantastic at first glance… only to then be revised much lower in subsequent months.

Conspiracy theorists believe this indicates that the Bureau of Labor Statistics (BLS) and other bean-counter agencies are massaging the data to make the economy look better than it is in order to push a narrative that Bidenomics works. Other people simply believe that the reason data is continually being revised lower is because the economic models the BLS and other agencies use are garbage with little value (after all, how great can the model be if it needs to be revised two or three times to get an accurate number).

Regardless of the reason this is happening, the impact is the same: investors are buying stocks based on a fantasy that the economy is booming.

The formula is as follows:

1) The initial data released about jobs or GDP or some other metric looks quite strong.

2) Investors pile into stocks based on the notion that the economy is booming.

3) The data is revised lower, usually more than once.

The key item here is that investors DON’T sell stocks at a later date based on the downward revisions… in fact, few if any investors even bother keeping track of this stuff. And that’s the problem: people are buying based on the illusion of strong economic growth when in reality the growth is much weaker if not indicative of contraction!

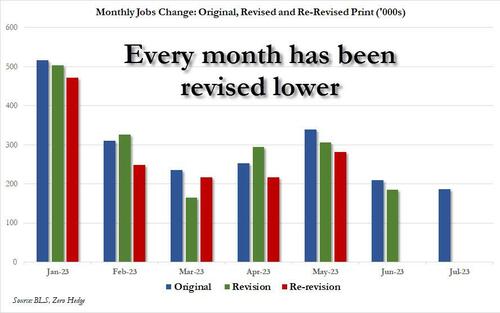

As Zerohedge noted a few days ago, the monthly payrolls report has been revised lower every single month in 2023. Again, this is not just one or two months with downward revisions… it’s every. single. month.

Now, you could easily argue that these downward revisions are simply because the BLS’s models are useless, but that’s missing the point: the headline data, or the data that investors use to justify buying stocks at 19 times forward earnings, is WRONG.

In fact, if we dig into less popular data that isn’t broadcast by the financial media, we get a VERY DIFFERENT picture of the U.S. economy.

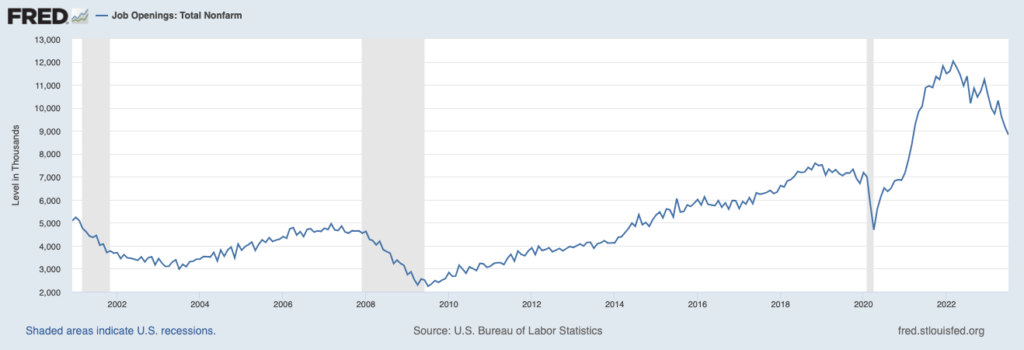

Take a look at the official job openings data taken from the Federal Reserve. Again, this is official data showing how many jobs are currently available in the U.S. economy. If the economy is booming and businesses are hiring people to expand their operations, why is this number cratering in ways usually associated with a recession.

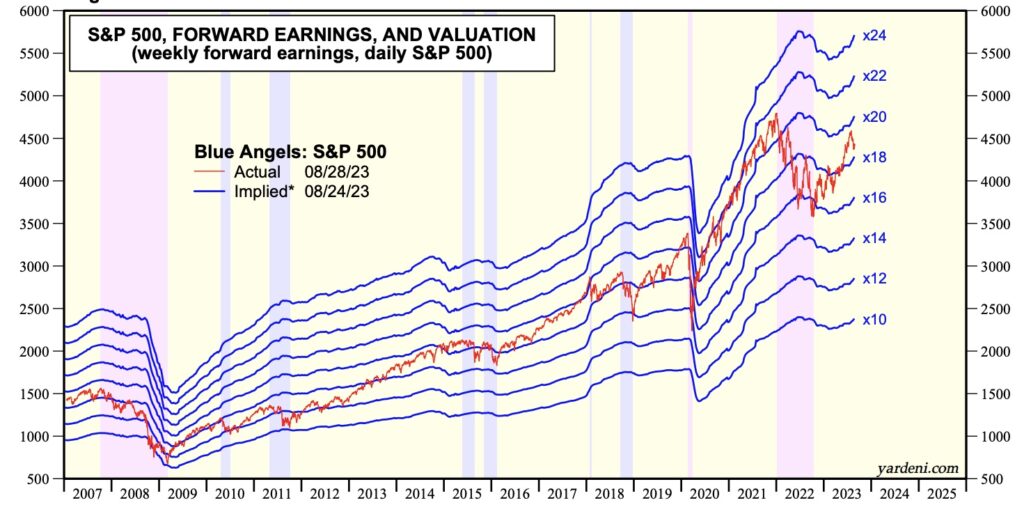

Meanwhile, investors are bidding stocks higher and higher. As I write this, the stock market is priced at 19 times forward earnings. The only time stocks are this richly valued is when A) the economy is expanding rapidly and B) the Fed is printing trillions of dollars in new month.

Today the economy is rolling over… and the Fed is DRAINING liquidity from the financial system. So again, investors are buying stocks based on a fantasy.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM.html