By Graham Summers, MBA

Try as they might, the bears simply couldn’t get it done last week.

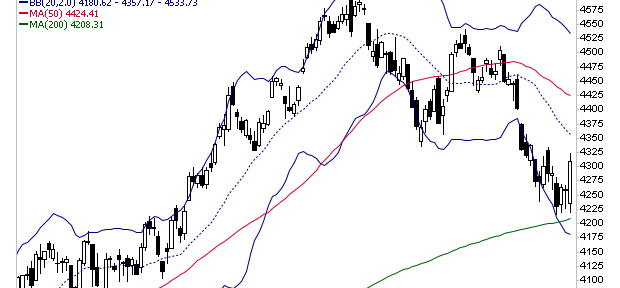

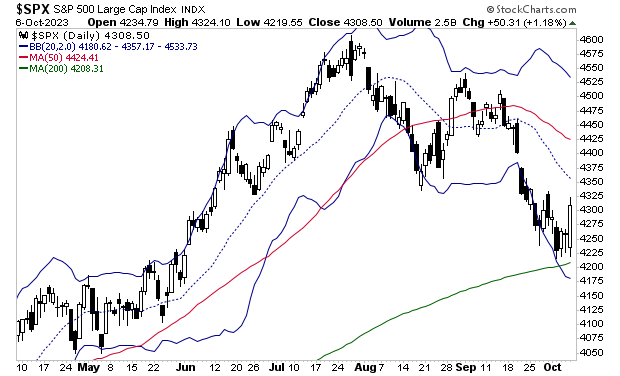

The S&P 500 spent a few days chopping around its 200-day moving average (DMA) before spiking higher on Friday. Much of this late week rally was short covering, but the fact remains that sellers simply didn’t have what it took to push stocks any lower.

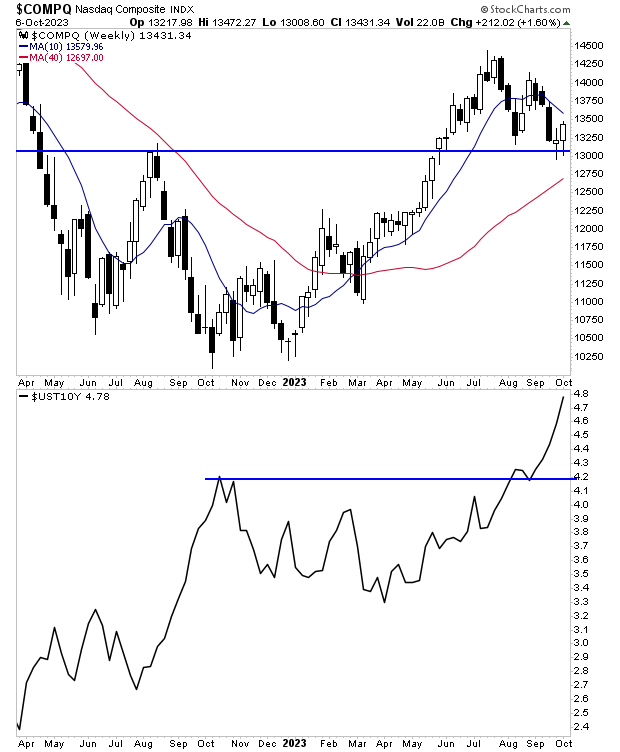

Indeed, the biggest news as far as stocks were concerned was the fact that the tech-heavy NASDAQ simply refused to take out support at 13,000.

Tech is a long-duration sector of the market… meaning it is heavily influenced by long duration bonds. The reason for this is that your typical tech start-up will take years before it brings a product or service to market and starts generating cash flow. So when you’re modeling a tech company’s future cash flows, you need to be thinking five years out or more. This means comparing a tech company’s future earnings against what you’d earn from owning a risk-free U.S. Treasury over the same time period.

Simply put, the tech sector is heavily influenced by what long-duration bonds do… which is why it’s truly astonishing that the NASDAQ has refused to break down despite the fact the yield on the 10-year U.S. Treasury spiked to new highs. The fact that stock market bears failed to crush tech is really quite bullish and a significant “tell” for the markets.

With all of this in mind, it’s quite possible stocks bottomed last week or will bottom this one. I remain concerned about a number of risks to the markets, but we have to respect price action. And price action tells us that stocks are strong in spite of many issues.

For more market insights and analysis, join our free daily market commentary Gains Pains & Capital. You’ll immediately start receiving our Chief Market Strategist Graham Summers, MBA’s briefings to your inbox every morning before the market’s open. Since 2015, Graham has shown investors a win rate of 75% meaning they made money on three out of every four positions closed.

And if you sign up today, you’ll also receive a special investment report How to Time a Market Bottom that the market set-up that has caught the bottoms after the Tech Crash, Housing Bust, and even the 2020 pandemic lows.

This report usually costs $249, but if you join Gains Pains & Capital today, you’ll receive your copy for FREE.

To do so…

https://phoenixcapitalmarketing.com/TMB.html