By Graham Summers, MBA

War has broken out in the Middle East.

As usual, everyone is attempting to have an “expert” take on this situation. The reality is that less than one in 10,000 of the people speaking on this stuff have any idea what they are talking about. And unfortunately this goes for the actual experts with degrees and pedigree.

Before listening to anyone opining on this conflict, ask yourself the following three questions:

1) Does this person know what kind of government the country or countries involved has? (parliament, congress, neither, theocracy, etc).

2) Could this person find the countries in question on a map?

3) Can this person name the leaders of the countries in question?

If the answer to all three of these isn’t YES, then ignore anything else this person has to say. If they’re too lazy to even spend five minutes learning the basics, then they’re just another fake guru trying to act like they’re omniscient.

With that in mind, I’m staying in my lane and focusing on the markets today. I’m doing this not because I don’t care about the people under attack, nor is it because I’m insensitive to the situation… I’m doing this because I’m not an expert on the middle east and have nothing to add in the way of quality insights.

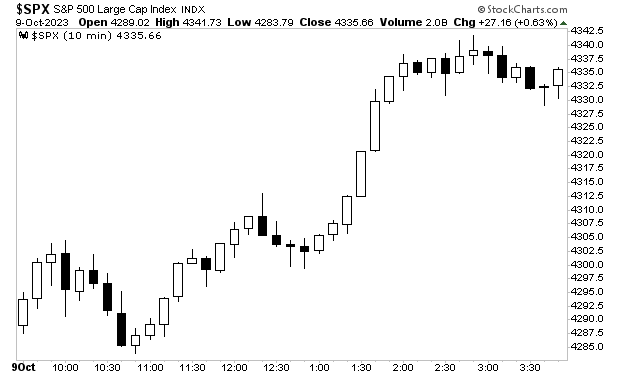

What I did note however was the stock market bounced hard from the initial sell-off yesterday and closed out the day at the highs. This is quite bullish given that the geopolitical situation.

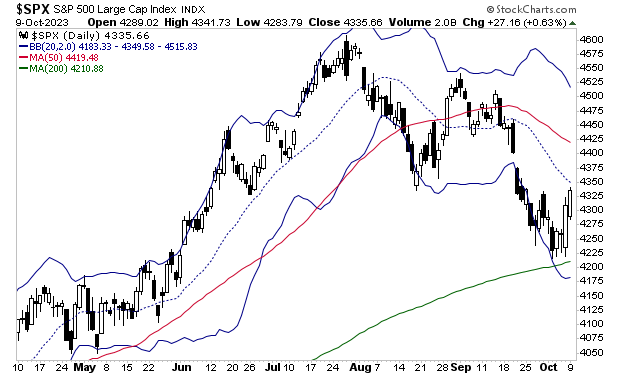

From a purely technical analysis situation, stocks bounced HARD off the 200-day moving average, or DMA, as represented by the green line in the chart below. The door is now open to a run to the 50-DMA as represented by the red line in the chart below.

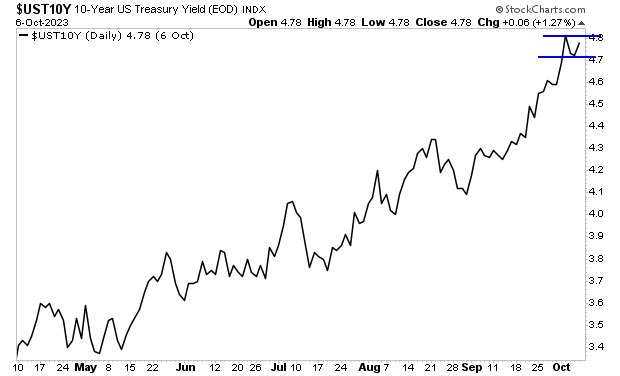

The key however is what happens to bonds.

The bond market was closed yesterday. So we need to assess how bonds act today now that they’re trading again. If yields break to new highs, then something BAD is coming for the stock market in the next few weeks.

Again, everything hinges on what bonds do. Bonds are the reason stocks rallied from 2020 to 2022. They’re the reason stocks crumbled from March 2022 to October 2022. So whatever happens in bonds will dictate what’s coming for stocks.

The key however is what happens to bonds.

The bond market was closed yesterday. So we need to assess how bonds act today now that they’re trading again. If yields break to new highs, then something BAD is coming for the stock market in the next few weeks.

Again, everything hinges on what bonds do. Bonds are the reason stocks rallied from 2020 to 2022. They’re the reason stocks crumbled from March 2022 to October 2022. So whatever happens in bonds will dictate what’s coming for stocks.

For more market insights and analysis, join our free daily market commentary Gains Pains & Capital. You’ll immediately start receiving our Chief Market Strategist Graham Summers, MBA’s briefings to your inbox every morning before the market’s open.

And if you sign up today, you’ll also receive a special investment report How to Time a Market Bottom that the market set-up that has caught the bottoms after the Tech Crash, Housing Bust, and even the 2020 pandemic lows.

This report usually costs $249, but if you join Gains Pains & Capital today, you’ll receive your copy for FREE.

To do so…

https://phoenixcapitalmarketing.com/TMB.html