By Graham Summers, MBA

Both stocks and bonds caught a bid mid-week on announcements that the Treasury has decided to issue less long duration bonds that previously expected.

This is GREAT news for risk assets in the short-term. It’s EXTRAORDINARILY BAD NEWS for EVERYTHING in the long-term.

Let’s me explain.

The recent sell-off in both bonds and stocks was driven by one primary concern: that the Treasury would need to issue a gargantuan amount of long-term debt to fund the Biden administration’s profligate spending.

In its simplest rendering:

1) The Biden administration is running the largest fiscal deficit as a percentage of GDP outside of WWII.

2) All of this spending requires the Treasury to issue massive amounts of debt.

Historically, the Treasury’s debt issuance consisted of 15%-20% short-term debt, and 80%-85% long-term debt. The reason for this was to avoid a rate shock should rates change dramatically in a 12-month period (all the short-term debt would come due at a time when rates were much higher).

It was this heavy reliance on long-term debt issuance that resulted in the 10-Year U.S. Treasury collapsing from late July through late October. And since stocks are generally a long-duration asset class, this pulled stocks down as well.

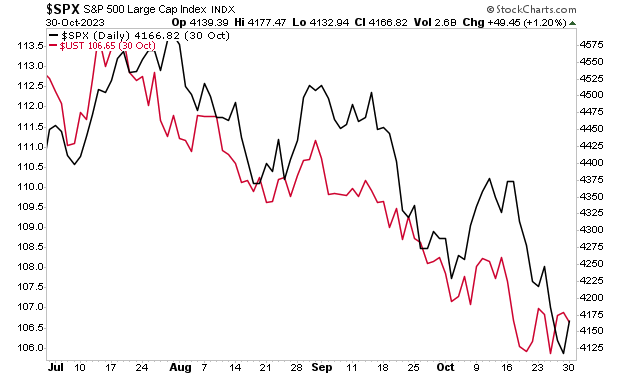

The below chart shows the 10-Year U.S. Treasury (red line) plotted against the S&P 500 (black line). As you can see, the two were trading in lock-step as soon as the Treasury announced its long duration debt issuance needs for the third quarter of 2023 on July 31st.

The Treasury took note of this collapse, which is why it announced a shift in focus for its 4Q23 debt issuance from long-term debt to short-term debt.

In its very simplest rendering, the Treasury intentionally removed the #1 concern for the stock market… thereby opening the door to a Santa Rally into year-end. Unfortunately, the cost of this is that the U.S. debt markets will be in VERY serious trouble a year from now.

Why?

Because this is a “one time” trick that cannot be repeated. Sure, it puts a floor under bonds for the time being, but unless the government cuts spending in a BIG WAY, sometime in the next 6-12 months all of this short-term debt will come due and the Treasury will once again need to issue long-term debt.

Mind you, the U.S. is currently adding debt at a pace of nearly $2 TRILLION per year. So you can only imagine the yield investors will require to lend money to Uncle Sam for any time period a year from now when our debt is over $35 trillion and we’re still running a ~$1 TRILLION deficit.

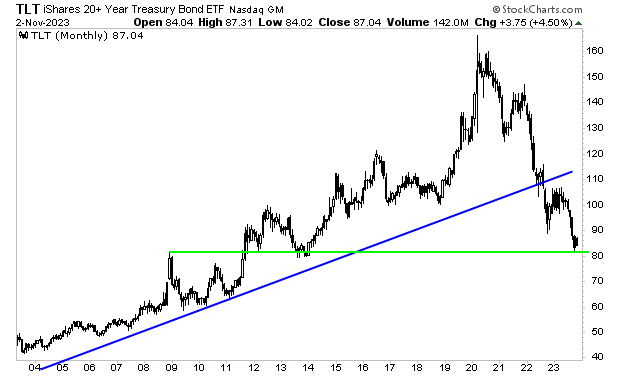

The below chart needs no explanation. Long-term Treasuries have broken their multi-decade trendline. They are now sitting on CRITICAL support. Once that green line goes, the debt crisis begins.

As I keep warning, the Great Debt Crisis of our lifetimes is fast approaching.

In 2000, the Tech Bubble burst.

In 2007, the Housing Bubble burst.

The Great Debt Bubble burst in 2022. And the crisis is now approaching.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

Normally this report would be sold for $249. But we are making it FREE to anyone who joins our Daily Market Commentary Gains Pains & Capital.To pick up your copy, swing by:

https://phoenixcapitalmarketing.com/BM.html