By Graham Summers, MBA

The following are excerpts from my Private Wealth Advisory market update to private clients written on 11-2-23. At that time the S&P 500 was trading in the 4,200s. It’s at 4,531 today.

The door is open to a Santa Rally to 4,600 or even higher on the S&P 500.

Why?

The Treasury just removed the single largest concern for stocks for the remainder of the year.

As I’ve noted previously, one of the most difficult aspects of stock market investing is that the market is a discounting mechanism for millions, if not billions, of pieces of information. The stock market represents the collective decisions of millions of individuals all of whom are thinking about a myriad of data points/ issues… and all of whom have literal money on the line.

However, out of all the millions or billions of pieces of information that the market is discounting at any given time, it typically only really cares about two or three issues at a time.

Sometimes it’s inflation. Other times it’s what the President is doing (or tweeting). Other times it’s China. Other times it’s what the Fed is doing or about to do. Other times it’s the economy. And so on and so forth.

What makes things even more difficult is the fact that the market changes its focus all the time. It might be really focused on inflation for a few weeks only to then ignore inflation for months on end. Similarly, the market might go weeks without acknowledging anything Fed officials say, only to then care a great deal about a single statement made by a single Fed official during an hour-long Q&A session.

I bring all of this up, because since late-July/ early-August 2023, the #1 thing the market has cared about has been the size of the Treasury’s long-duration debt issuance…

On July 31st 2023, the Treasury announced its financing needs for the third quarter (July through September). The Treasury announced it would:

1) Need to borrow $274 billion more than previously expected.

2) Increase its issuance of longer duration Treasury bonds for the first time since 2021.

Regarding #2, the actual increase in dollar terms of long duration bonds that the Treasury needed to issue was relatively small ($102 billion vs. $96 billion). However, the fact that there was increase in long duration issuance, combined with the increase in total debt issuance ($274 billion) was a surprise.

And the bond markets HATE surprises.

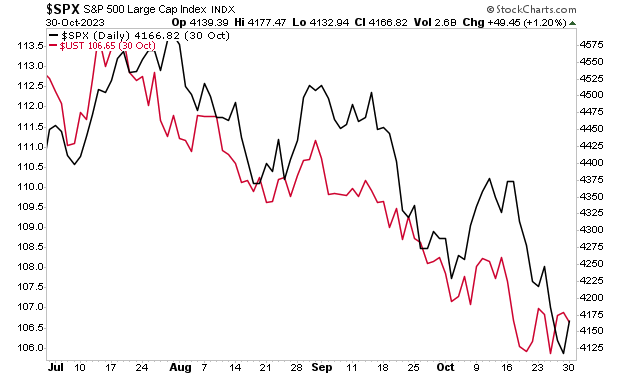

Since that time, bond investors have been dumping ALL long duration bonds. This has resulted in long-term Treasury yields rising (bond yields rise when bond prices fall). And because the stock market is priced based on long-duration Treasury yields, this has meant a sell-off in stocks.

The chart bel shows the yield on the 10-Year U.S. Treasury and the S&P 500 from the last QRA announcement on July 31st 2023 until last week. As you can see, the two items have been moving in lockstep.

Which brings us to this week (week of 10-30-23).

On Monday the 30th of October, the Treasury issued its QRA for the fourth quarter of 2023. It surprised the markets (in a good way) by stating that it would borrow only $776 billion (this was $76 billion less than previously expected).

Then, on Wednesday (11-1-3), the Treasury released its Report to the Secretary of the Treasury from the Treasury Borrowing Advisory Committee.

In it, the Treasury Borrowing Advisory Committee wrote the following (emphasis added)

The Committee supported meaningful deviation from the historical recommendation for 15-20% T-Bill share. While most members supported a return to within the recommended band over time, the Committee noted that the work Treasury has done to meaningfully increase WAM over the past 15 years affords them increased flexibility with T-Bill share in the medium term.

Source: Treasury.gov

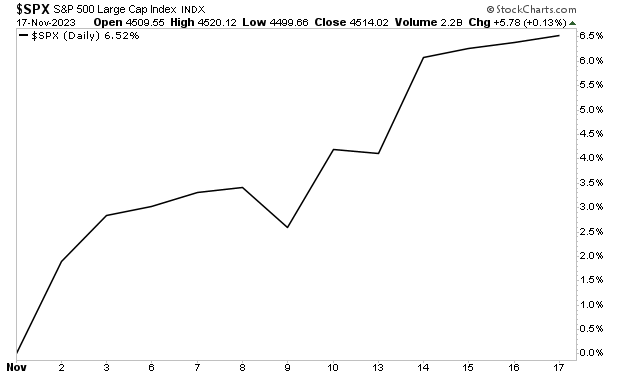

As I explained to clients in the remainder of this market update, the decision of the Treasury to rely extensively on short-term T-bills to finance the deficit would ignite a “risk on” rally that will likely last into year-end.

Since that time, the S&P 500 has done this:

For more market insights and analysis, join our free daily market commentary Gains Pains & Capital. You’ll immediately start receiving our Chief Market Strategist Graham Summers, MBA’s briefings to your inbox every morning before the market’s open.

And if you sign up today, you’ll also receive a special investment report How to Time a Market Bottom that the market set-up that has caught the bottoms after the Tech Crash, Housing Bust, and even the 2020 pandemic lows.

Even more importantly, you’ll find out what this trigger says about the market today!

This report usually costs $249, but if you join Gains Pains & Capital today, you’ll receive your copy for FREE.

To do so…

https://phoenixcapitalmarketing.com/TMB.html