By Graham Summers, MBA

What comes next for stocks?

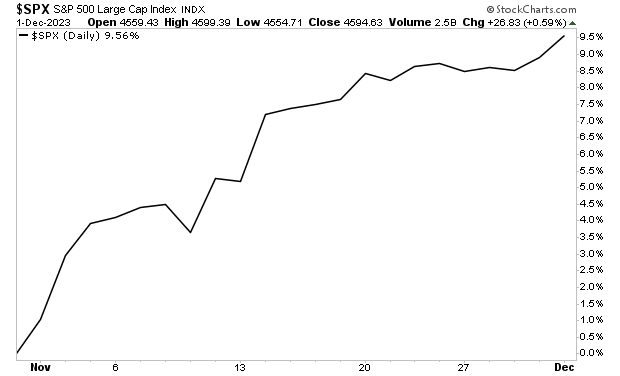

The S&P 500’s performance for the month of November 2023 was one of the best single month performances for stocks in the last 30 years. Stocks finished the month up 9.5%, a truly incredible return.

The big question is “what’s next for the markets?”

The answer is “rotation.”

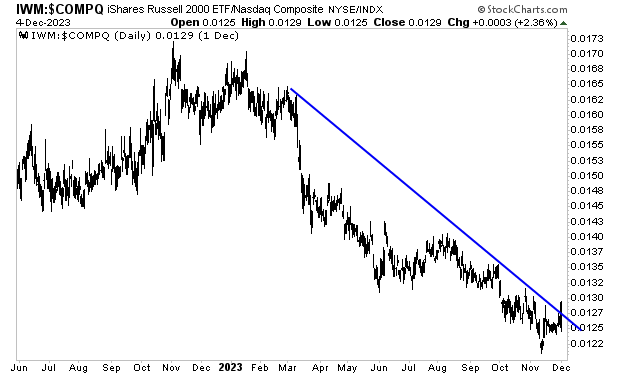

Tech led the rally as Big Tech blasted higher throughout November while much of the rest of the market lagged behind. We are now seeing capital flowing into some of of the laggards, specifically small caps.

The ratio between the NASDAQ and the Russell 2000 has been in a downtrend for most of 2023 as Tech stocks outperform small caps. We are now seeing a break of this downtrend to the upside as small caps finally catch a bid and Tech consolidates

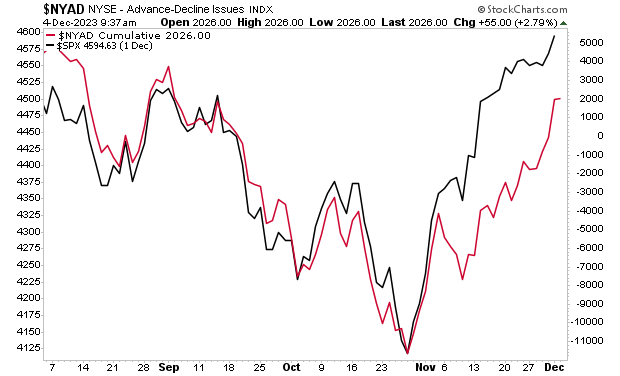

This rotation is allowing overall breadth to improve as non-Tech stocks catch up to Tech leaders. You can see this clearly in the chart below in which breadth (red line) is catching up to the Tech sector (XLK).

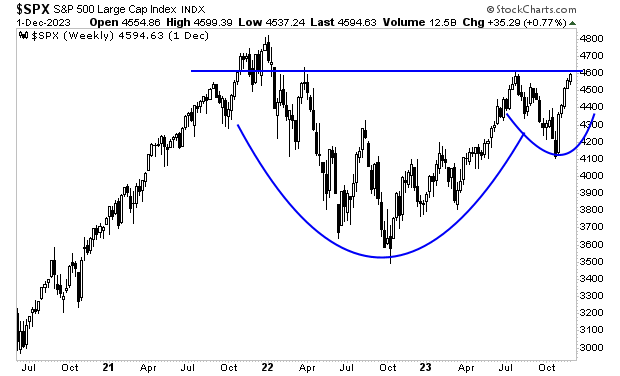

After this rotation/ catch up is finished, stocks go to new all time highs. The Cup and Handle formation in the long-term chart for the S&P 500 is clear.

For more market insights and analysis, join our free daily market commentary Gains Pains & Capital. You’ll immediately start receiving our Chief Market Strategist Graham Summers, MBA’s briefings to your inbox every morning before the market’s open.

And if you sign up today, you’ll also receive a special investment report How to Time a Market Bottom that the market set-up that has caught the bottoms after the Tech Crash, Housing Bust, and even the 2020 pandemic lows.Even more importantly, you’ll find out what this trigger says about the market today!This report usually costs $249, but if you join Gains Pains & Capital today, you’ll receive your copy for FREE. To do so…

https://phoenixcapitalmarketing.com/TMB.html