By Graham Summers, MBA

The Fed and the Treasury are juicing the markets to help the Biden administration with its 2024 re-election bid. And their actions are going to result in a massive crisis hitting some time in 2025.

The Fed is supposed to be politically independent, but everyone knows that is a fairytale. The Bernanke-led Fed introduced QE 3 a mere two months before the 2012 election to help the Obama administration. Moreover, former Fed Vice-Chair Stanley Fisher admitted that the Powell-led Fed intentionally raised rates in December 2018 (triggering a stock market crash) to hurt the economy under former President Trump.

Put simply, anyone who tells you that the Fed doesn’t play politics hasn’t been paying attention. And it is clear that today’s Fed led by Jerome Powell and today’s Treasury led by Janet Yellen are actively juicing the markets and economy to help the Biden administration with its claims that the economy is booming and everything is great.

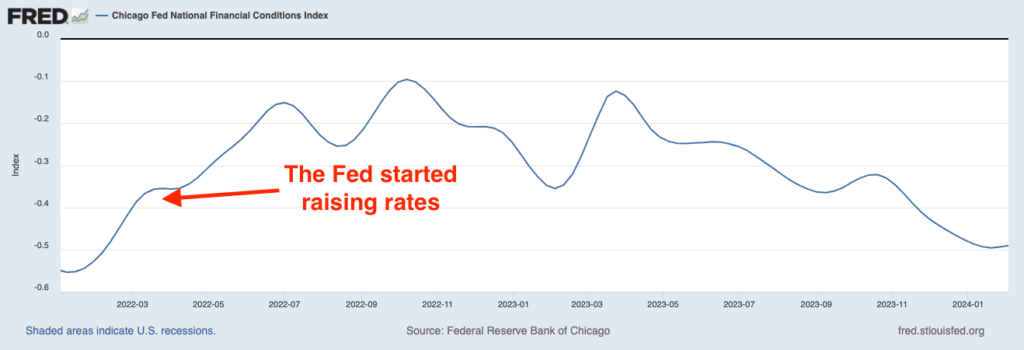

Case in point, the Fed is talking about easing monetary conditions at a time when the stock market is at all-time highs and financial conditions are LOOSER than they were when the Fed first started raising rates! Why do this? To keep stocks higher for the election.

The Fed is not the only one in on this scheme.

The Treasury is pulling out all the stops to help the Biden administration. Typically, the U.S. runs a massive deficit during recessions in order to cushion the economic contraction. Today the U.S. economy is technically still growing… and the Biden administration is running the U.S.’s largest deficit as as percentage of GDP in history (outside of World War II).

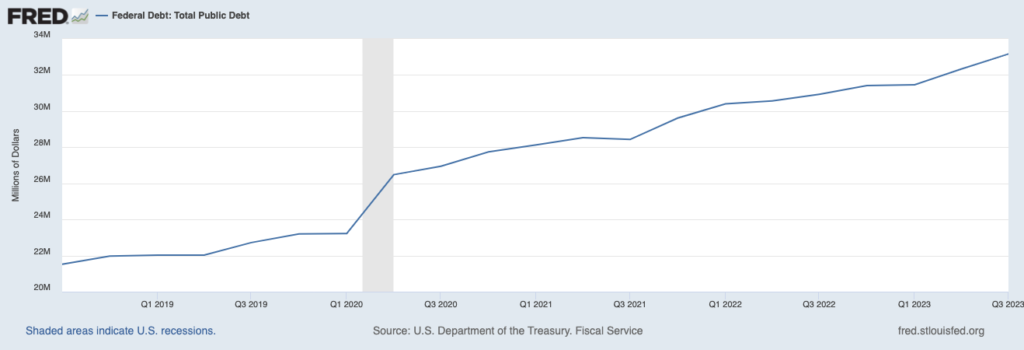

Put another way, the U.S. is running emergency levels of social spending at a time when the economy is still growing. And this is adding trillions of dollars in new debt to the U.S.’s liabilities every year.

The U.S. owed $28 trillion in debt when Joe Biden was sworn into office in 2021. It owes $33 trillion today. And the pace of debt issuance is speeding up, not slowing down: the U.S. has added $2 trillion in debt in the last 12 months alone. You can thank Treasury Secretary Janet Yellen for signing off on this insanity.

Worst of all, the above items are happening for political purposes. There are ZERO fundamental reasons for the Fed and the Treasury to be implementing the above policies. But in today’s world of political corruption and systemic abuse of power, it’s simply how things are.

I’ll address how to profit from this in tomorrow’s article. If you’d like it delivered to your inbox, all you have to do is join our FREE daily investment commentary GAINS PAINS & CAPITAL.

To do so click the link below…

https://gainspainscapital.com/subscribe/