Our latest theme is that the U.S. Central Bank, called the Federal Reserve, or the Fed for short, is NOT politically independent, but is in fact a highly partisan organization that leans left.

The above items are not some conspiracy theory. The Fed’s own actions support this view.

By quick way of review…

1) The Bernanke-led Fed launched QE 3 just three months before the 2012 Presidential election. At the time, the economy was growing, unemployment was falling, and there were no signs of systemic duress in the financial system. So this was a clear intervention to aid the Obama Administration’s 2012 re-election bid.

2) The Fed kept rates at zero for seven of the eight years President Obama was in office. Once it finally got around to raising rates, it engaged in one of the feeblest hiking schedules in history, raising them only once in 2015

and once in 2016.

3) Donald Trump won the 2016 Presidential election in a major upset to the political establishment. At that point the Fed suddenly began raising rates three to four times per year while simultaneously draining $500 billion in liquidity from the financial system.

4) Today, the Fed is actively juicing the stock market via multiple credit facilities designed to provide liquidity to help the Biden administration with its re-election bid. The Fed is also promising to cut rates despite the fact it’s an election year and inflation has not fallen to its 2% target.

I wish this was the end of this disturbing exercise, but it’s not: the Fed is also letting housing bubble up again. The reason? You guessed it, real estate is the single most owned asset class in the U.S. And boosting home prices during an election year is likely to sway voters.

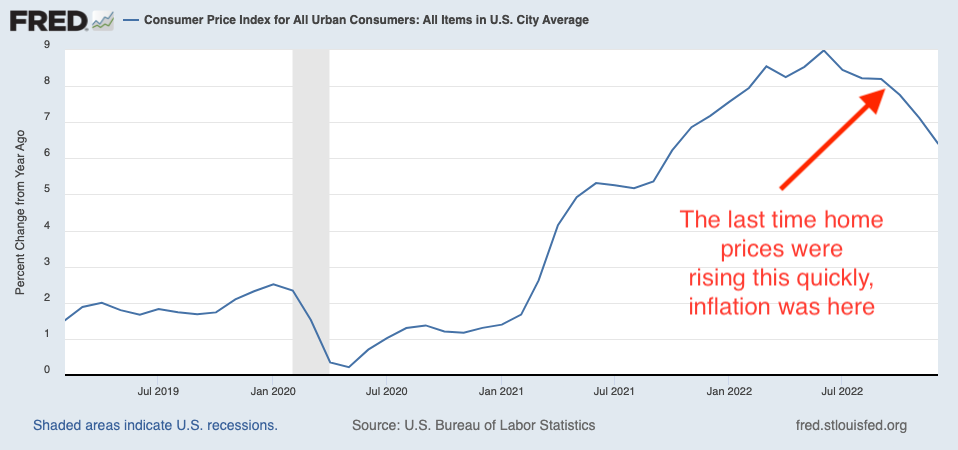

TheS&P CoreLogic Case-Shiller U.S. National Home Price Index rose 6% in January. This is up from 5.6% in December 2023. As HousingWire notes, this represents the seventh consecutive month of annual price growth. It’s also the biggest increase since November 2022.

By the way, inflation was around 6% at that time!

So we’ve got both real estate and stocks bubbling up again, courtesy of the Fed playing political games. In the near-term this is fantastic for Americans, who will see their net worth rise as a result of this.

The bad news is that there’s no such thing as a free lunch. And the Fed’s political shenanigans are unleashing a second wave of inflation.

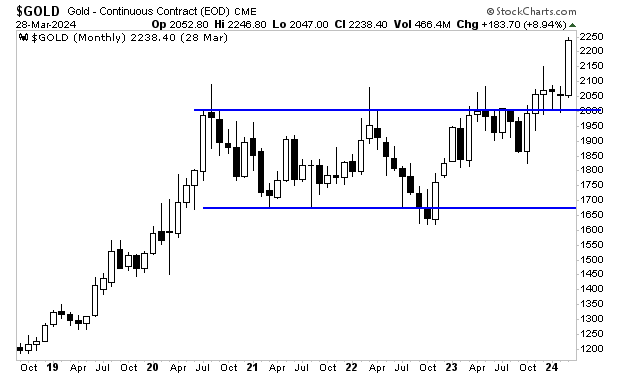

Gold has figured it out. It recently exploded to new all-time highs.

The good news is that those investors who are properly positioned for this stand to generate truly EXTRAORDINARY returns in the coming months.

On that note, the FREE copies of our Special Investment Report detailing three investments that will profit from the next round of inflation are rapidly being reserved. So if you want reserve one, you better move fast!

To pick up your copy, go to:

Graham Summers

Chief Market Strategist

Phoenix Capital Research, MBA