Stocks look due for a pullback.

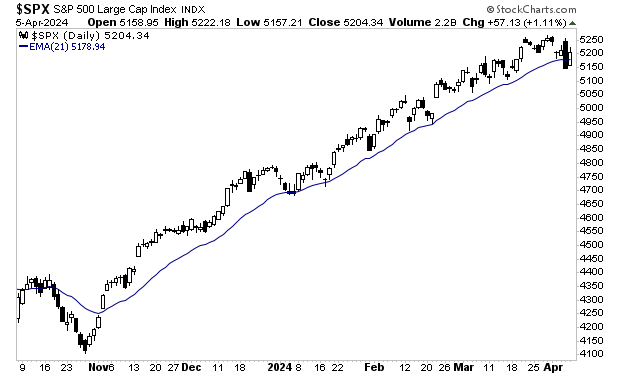

Ever since the S&P 500 bottomed in late October/ early November 2023, the 21-day exponential moving average (EMA) has served a major “trend line.” Put simply, whenever stocks fell to test this line, they “bounced” soon after and the rally continued.

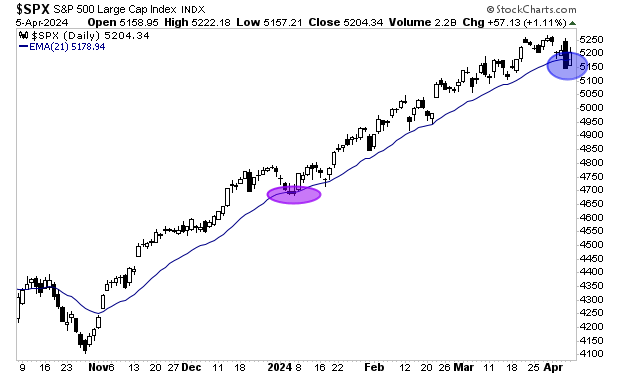

Last week’s price action featured a different dynamic. Stocks fell to test the 21-EMA and struggled to reclaim it for two sessions (blue oval in the chart below). The only other time this happened was during the brief market pullback in early January 2024. At that time, the market rebounded sharply on the third trading session (purple oval in the chart below).

In this context, today’s price action is key. If the S&P 500 rallies hard and reclaims the 21-EMA, then it’s likely stocks will rally to new highs. However, if stocks cannot reclaim the 21-EMA with conviction today, then we’re likely to see more downside for stocks.

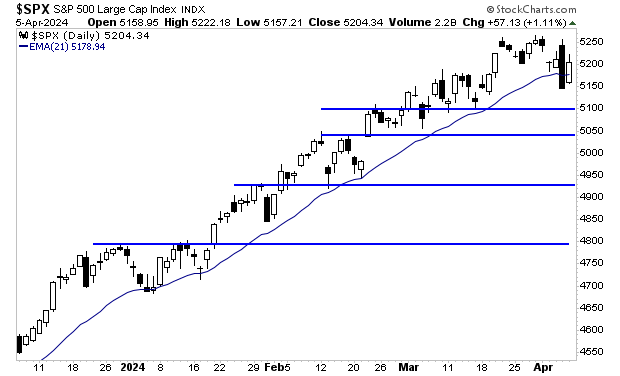

I’ve illustrated the S&P 500’s support lines in the chart below.

If you’re interested in taking advantage of a unique situation in the stock market today, the FREE copies of our Special Investment Report detailing three investments that can profit from inflation are rapidly being reserved. So if you want reserve one, you better move fast!

To pick up your copy, go to:

Graham Summers

Chief Market Strategist

Phoenix Capital Research, MBA