By Graham Summers, MBA

The economy is showing a strange dichotomy.

On the one hand, the economic data ranges from good to great, with GDP growth clocking in at an annualized rate of 3.9%, and the economy adding ~300,000 jobs per month.

On the other hand, President Biden has the worst job approval rating in 70 years with just 38.7% of Americans approving of his efforts. And always remember, Americans vote with their wallets.

How are these two items possible? How can the economy be doing so well and President Biden be so unpopular?

The answer is quite simple: Bidenomics is actually Bubble-nomics through which the Federal Reserve juices the stock and real estate markets to levels that have no real connection to reality.

Those Americans who make up the top 20%, and especially the top 1% of the economy (the ones who own a lot of stocks and real estate) are doing GREAT. Everyone else? Not so much.

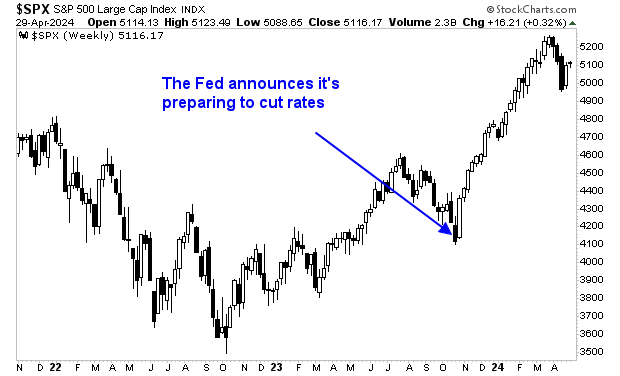

It all started in November of last year. At that time, the Fed announced that it was getting ready to start cutting interest rates despite the fact that inflation was still well above 3% and financial conditions were actually looser than they were before the Fed started tightening monetary policy to end inflation!

Stocks literally EXPLODED higher on the announcement and haven’t looked back.

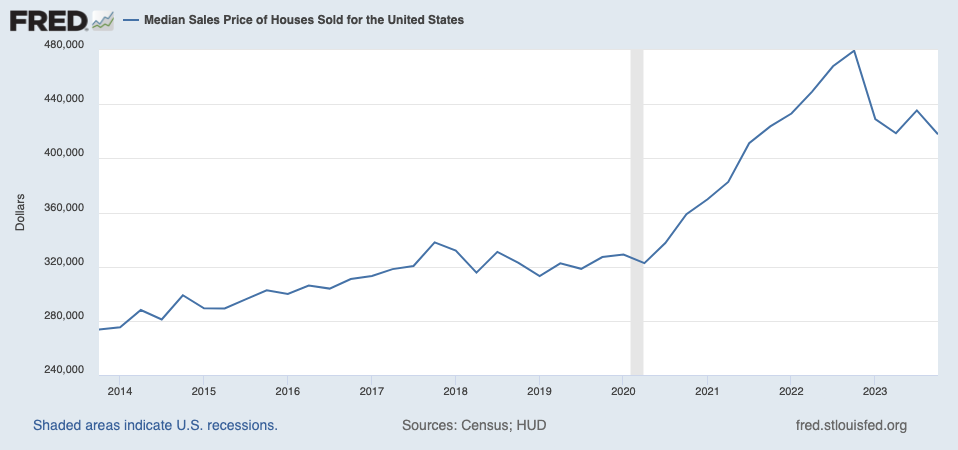

As for real estate, the Fed effectively cornered the Mortgage-Backed Securities (MBS) market during the pandemic, sending home prices through the roof. Even with this market cooling in the last year or so, prices are WAY higher than they were before the Fed intervened.

By the way, once the Fed starts cutting rates, this market will also explode higher as two-years of pent up demand (mortgage rates were prohibitively high for most of the last two years) comes to market.

The top 20% of the country, particularly the top 1%, who own more assets that the entire Middle Class (the mid-60% in income brackets) have seen their net worth EXPLODE higher during President Biden’s first term.

These individuals comprise an extreme amount of the consumer spending/ economic drivers that are masking how the other 99% of the country are doing.

What does this mean for the markets?

I’ll detail that in tomorrow’s article.

On that note, we recently published a Special Investment Report detailing three investments that will profit from the inflationary effects of Bidenomics. Normally this report would cost $499, but we are giving copies FREE to anyone who joins our daily market commentary.

To pick up your copy, go to:

Graham Summers

Chief Market Strategist

Phoenix Capital Research, MBA