by Graham Summers, MBA

As I outlined yesterday, the Fed is in a panic.

By quick way of review:

- The Fed stopped raising rates in June 2023.

- Since that time, the Fed has shifted to talking about easing monetary conditions.

- This has ignited a second wave of inflation.

- On an annualized basis, the 1-month change in inflation is 3.9%

- On an annualized basis, the 3-month change in inflation is 4.4%

- This resurgence in inflation has benefited former President Trump’s campaign as Americans by and large vote with their wallets.

- Former President Trump has set his sights on the Fed.

Regarding #5, Trump is convinced the Fed plays politics to benefit the establishment/ leftists. He believes the Fed intentionally sabotaged the economy during his first term by raising rates aggressively from 2017-2019. He also believes the Fed is actively juicing the markets to help the Biden administration today (he’s not wrong there).

And unlike his prior attacks on the Fed, which largely consisted of tweets and interviews in which he mocked Fed officials, this time around, Trump is planning to take action if elected.

Trump’s advisors recently leaked a proposal to overhaul the Fed completely should Trump win in 2024. Among the various proposals:

- Allowing Trump to fire Fed Chair Jerome Powell before the latter’s term is up.

- Revising the Fed’s leadership structure to include the White House in decisions concerning monetary policy (including cutting or raising interest rates).

- Using the Treasury to keep Fed policy “in check”

Let me be clear here: I’m not saying that I agree with Trump’s proposals or that a Trump win in 2024 would be a good thing. I’m simply pointing out, as a statement of fact, what Trump plans to do if he wins.

This terrifies the Fed. If there’s one thing policymakers DON’T like, it’s being told what to do, or worse still, being fired.

And thus the Fed is in a pickle. On the one hand, it wants to do everything it can to juice the economy/ stock market to insure Trump doesn’t win.

But on the other hand… juicing the financial system is highly inflationary, which makes it more likely that Trump will win!

So what does this mean for stocks?

Increased volatility.

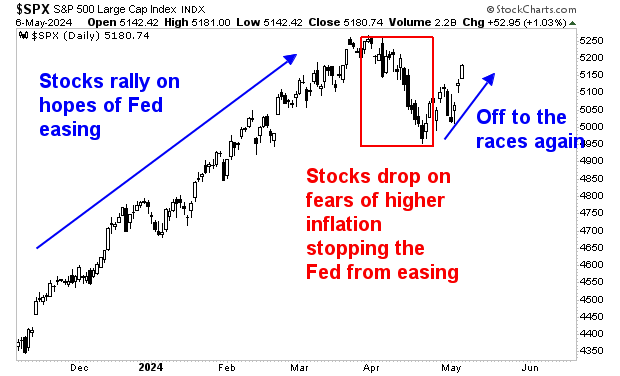

Stocks are being pulled in two directions shifting from focusing on potential Fed easing, to worrying about higher inflation resulting in the Fed having to tighten again.

We’ve already gotten a taste of this in 2024.

Stocks came into the year roaring higher on hopes of the Fed cutting rates. Then inflation began to tick upwards, resulting in stocks falling on fears that the Fed wouldn’t be able to cut rates any time soon.

We’re not talking about small price swings either as the below chart illustrates.

What does this mean for investors?

Your best bet is to ride the inflationary impulse into the election. After that, everything hinges on who wins.

What investments will profit the most from this situation?

To answer that, we recently published a Special Investment Report detailing three investments that will profit from the Fed’s inflationary mistakes. As I write this, all three of them are exploding higher.

Normally this report would cost $499, but we are giving copies FREE to anyone who joins our daily market commentary.

To pick up your copy, go to:

Graham Summers

Chief Market Strategist

Phoenix Capital Research, MBA