Everything hinges on bonds.

Forget the White House, forget the Treasury, forget the Fed. The bond market is in the driver’s seat. And if bonds don’t settle down, either A) the Trump administration will be forced to abandon its trade war or B) the Fed will be forced to intervene.

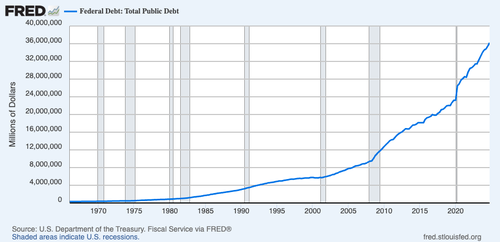

As I wrote in my 2017 best-selling book The Everything Bubble, the only reason the U.S. has been able to get away with papering over declining living standards for the last 50 years has been because bonds allowed it to happen. With bond yields declining steadily since the early 1980s, the political class/ Fed were able to issue an ever-increasing amount of debt/ credit into the financial system.

In chart form, THIS:

Is what allowed this to happen:

I bring this up, because President Trump has decided he wants to reverse outsourcing, bring back the U.S.’s manufacturing base, and balance the budget. And he’s decided that the tool to accomplish all three is tariffs.

The only issue is the bond market isn’t buying it. The yield on the all-important 10-year U.S. Treasury came dangerously close to breaking above 4.8% during the last two weeks.

Why is this a big deal? Weren’t these bonds yields at 5%+ a mere 15 years ago?

The U.S. has added over $20 TRILLION in debt since that time. And it needs to roll over $9 TRILLION of that in the next 12 months. The Trump administration is DESPERATE to do this via LONG-TERM debt rather than short-term debt.

But if bonds don’t play ball, the Trump administration will be up you know what creek without a paddle. A spike in bond yields with the U.S’s massive debt overhand (interest payments are now the single largest outlay in the U.S.’s budget) would mean the Everything Bubble finally bursting.

The crisis that would unfold would make 2008 look like a picnic. So if you’ve yet to prepare for this, the time to act is NOW before the bond market revolts.

Indeed, our proprietary Crash Trigger is now on red alert. This trigger went off before the 1987 Crash, the Tech Crash, and the 2008 Great Financial Crisis.

We detail this trigger, how it works, and what it’s saying about the market today in a Special Investment Report titled How to Predict a Crash.

Normally this report is only available to our paying clients, but in light of what’s happening in the markets today, we are making just 99 copies available to the general public.

To pick up one of the remaining copies…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research