What’s really in the Big Beautiful Bill?

Depending on who you listen to, the Big Beautiful Bill is either an incredible piece of legislation that will codify tax cuts while also unleashing growth and reducing the deficit, OR it’s just another 1,000+ page of pork that maintains the status quo of overspending/ growing the deficit/ increasing the debt.

The problem with this situation is that the people pushing these claims are either A) individuals who HATE the President and his agenda or B) individuals who work for the Trump administration and so have a vested interest in getting the bill passed.

Neither of those two groups are unbiased. And to be frank, I doubt ANYONE talking about this bill has even read it. Who has time? It only just passed the House on 5/22/25 and it’s 1,116 PAGES LONG!

So rather than arguing one way or the other, let’s let Mr. Market tell us the real deal with this bill.

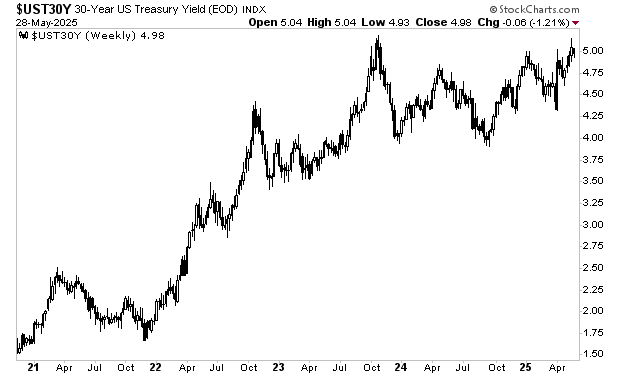

Mr. Bond is telling us the bill will increase spending. The yield on the 30-Year U.S. Treasury is at 5%, which is right near the top of its range for the last five years. This is also the highest this bond’s yield has traded since President Trump took office.

If the Big Beautiful Bill (BBB) was designed to cut spending and reduce the debt, this bond would be rallying, resulting in its yield falling. That is NOT happening.

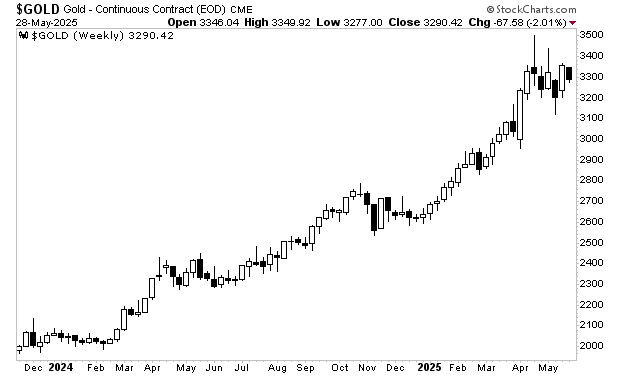

Mr. Gold is saying the same thing.

The precious metal is highly sensitive to money printing/ debt levels. And as I write this, gold is near its all-time highs, trading at roughly $3,300 per ounce. Again, if the BBB was going to reduce the debt and cut spending you’d expect this asset to be going in a different direction.

Of course, it’s possible that the markets are WRONG about the BBB. But considering that the markets are a composite of the actions of millions of people all with “skin in the game,” it’s highly likely that Mr. Market is more accurate that Trump administration officials or analysts/ commentators who openly despite the President.

As investors, our job is to make money, NOT play politics. So, when Mr. Market speaks, it’s usually a good idea to listen. And smart investors are actively taking steps now to profit from this.

We detail this situation, what’s to come, and THREE investments to profit from it in a Special Investment Report titled How to Profit a Inflation.

Normally this report is only available to our paying clients, but in light of what’s happening in the markets today, we are making just 99 copies available to the general public.

To pick up one of the remaining copies…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research