Wall Street is high fiving itself today because the Fed’s preferred inflation measure, the Personal Consumption Expenditures or PCE came in slightly cooler than expected. PCE grew at a pace of 0.1% month over month for the month of April. This matched expectations. However, year over year PCE was just 2.1% which was below expectations of 2.2%.

Put simply, the most important inflation number proved to be slightly better than most analysts expected. Surely that means that inflation is going away and will continue to do so, right?

Not necessarily.

It turns out that PCE is a TERRIBLE predictor of future inflation. What’s even more astonishing is that Fed’s OWN RESEARCH shows this.

You see, back in 2001, the Fed had several researchers dive into the subject of inflation. Their goal was the analyze whether the Fed’s preferred measures of inflation (CPI and PCE) are decent predictors of future inflation. The Fed also investigated a whole slew of other inflation measures for comparison purposes.

The results?

The Fed found that food inflation, NOT CPI or PCE, was the best predictor of future inflation. Fed researchers wrote the following:

We see that past inflation in food prices has been a better forecaster of future inflation than has the popular core measure [CPI and PCE]…Comparing the past year’s inflation in food prices to the prices of other components that comprise the PCEPI (as in Table 1), we find that the food component still ranks the best among them all…

Source: St Louis Fed (emphasis added).

Now, food is made from agricultural commodities. And as the below chart shows… those aren’t exactly in a downtrend. They’ve more than doubled in price since 2020 and continue to rise. So, the disinflationary impulse that everyone is so excited about is likely more to do with accounting gimmicks that reality.

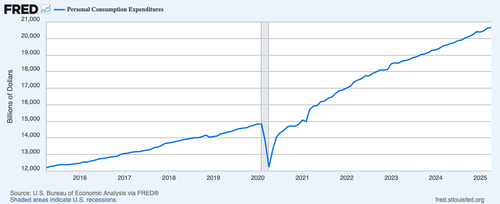

Indeed, even the official data only shows this. If you look at PCE as a number rather than a year over year change, then it is clear that prices have been going up since 2020 and will continue to do so. The fact they’re not going up as quickly as before is VERY different from claiming that prices are coming down.

Small wonder then that consumers continue to cite inflation as a MAJOR problem. This also explains why gold is hovering near its all-time highs at ~$3,400 per ounce. If DIS-inflation was indeed the primary theme for the financial system, gold would be getting crushed right now.

It’s not.

The reality is that inflation hasn’t gone away, no matter what the “official” data points suggest. I know this. You know it. The markets know it too. Which is why smart investors are actively taking steps to prepare for another round of inflation hitting the financial system later this year.

We detail this situation, what’s to come, and THREE investments to profit from it in a Special Investment Report titled How to Profit From Inflation.

Normally this report is only available to our paying clients, but in light of what’s happening in the markets today, we are making just 99 copies available to the general public.

To pick up one of the remaining copies…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research