We are in a two-tier bull market.

While most stocks are up from the April lows, certain companies are outperforming by a wide margin. The overall market as measured by the S&P 500 is up 22% from the April lows. However, certain companies have produced gains that are exponentially greater than that, rallying 50% or even more than 100% in the last eight weeks.

This is not an accident. The stock market is rewarding certain qualities right now while downplaying others. And those companies that are outperforming all have two specific qualities.

- They are all high growth with rapid increases in their toplines.

- They have little if any exposure to tariffs and the trade war.

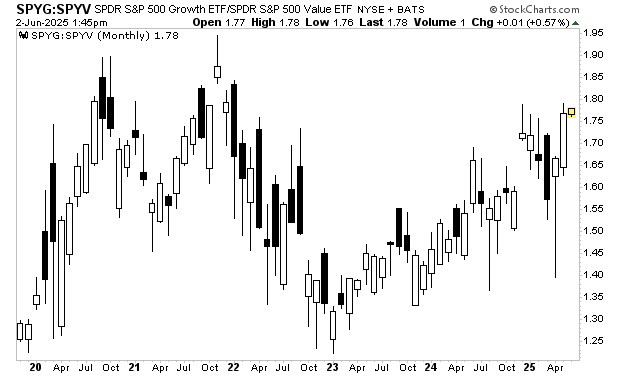

Regarding #1, below is a chart showing the ratio of the S&P 500 Growth ETF to that of the S&P 500 Value ETF. When this chart rallies, growth is outperforming. When this chart falls, Value is outperforming. As you can see, growth stocks are DRAMATICALLY outperforming value stocks right now. In fact, this ratio is fast approaching the all-time highs hit in 2021. Put simply, right now the market is rewarding growth over value.

The second quality the top performing stocks all have is little if any exposure to the tariffs. While it is now clear that the Trump administration prefers deals to a prolonged trade war, the reality is that trade negotiations are rarely if ever smooth or quick. The average trade deal takes over 18 months to be complete. And as the situation with China has proved, progress is usually accomplished via a “two steps forward, one step back” pattern.

With that in mind, capital is rapidly flowing to those companies that have little if any exposure to the tariffs.

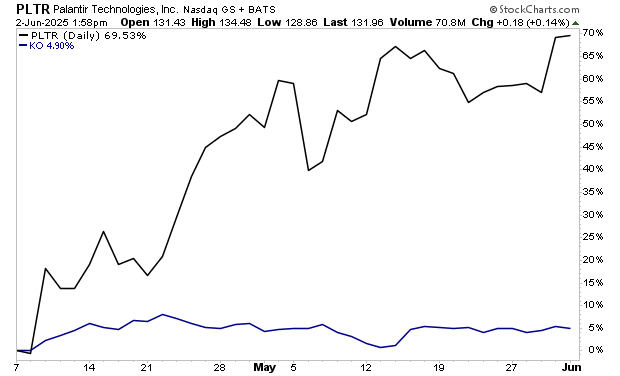

Compare the stock market performance of a company like Palantir (PLTR) to that of Coco-Cola (KO). Their market capitalizations are roughly the same ~$300 billion, but PLTR, which is high growth oriented, software data analytics company with little if any exposure to tariffs is dramatically outperforming KO, which has slower growth (but a lot more in profits) and considerable exposure to the trade war/tariffs (KO products are in most countries worldwide).

Again, this is a two-tier stock market. Practically everything is up from the April bottom, but certain companies are benefiting from the current market more than others. These are the companies investors need to be focusing on with their capital.

We detail four such investments in a Special Investment Report Tariff Proof Stocks: four high growth companies unaffected by the trade war.

As I write this three of them just hit new all-time highs. The fourth isn’t far behind either.

Normally this report is only available to our paying clients, but in light of how this stock market is behaving, we are making just 99 copies available to the general public.

To pick up one of the remaining copies…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research