By Graham Summers, MBA | Chief Market Strategist

If you don’t have at least some exposure to tariff-proof stocks, you’re missing out.

As I wrote yesterday, the current stock market is one in which some stocks are exploding higher while others are left behind. The ones that are exploding higher all share certain attributes, specifically…

- They are high growth.

- They have little if any exposure to the trade war/ tariffs.

Regarding #1, it is clear that we are late in the economic cycle.

The U.S. has not had an organic recession since 2007 (the 2020 recession was induced on purpose). One of the hallmarks of late-cycle economies is slowing growth. Our current cycle is no different: annual GDP growth is typically sub-3% in recent years.

In this context, those companies with rapid top line growth are highly prized by the markets as they provide the opportunity of much higher profits/ cash flows. After all, if the broader economy is growing at 3% or less, why wouldn’t you reward corporate growth that is in the double if not triple digits?

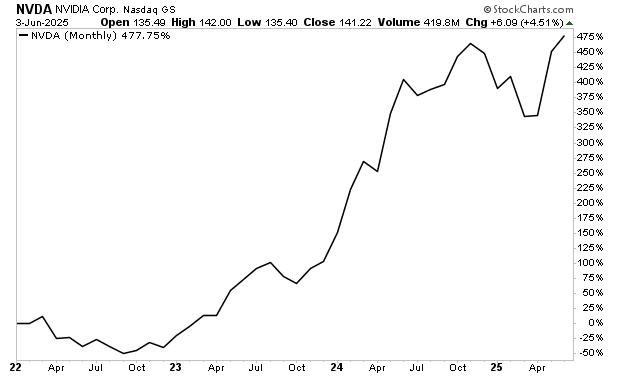

Take a look at Nvidia (NVDA) and you’ll see what I mean. NVDA went from producing ~$27 billion in revenue in 2022 to over $130 billion in revenue in 2024. That is a four-fold increase in revenues at a time when the average annual topline growth for S&P 500 companies was just 5%.

As a result of this rapid growth, the stock market has rewarded NVDA handsomely with NVDA shares up nearly 500% since 2022. Again, this is a stock market that GREATLY values growth over other metrics.

Which brings us to #2 in our list of stock market priorities: this is a stock market that LOVES companies with little if any exposure to the trade war/ tariffs.

As far as the actual economy is concerned, the effect of the trade war and tariffs has been minimal. All of the hard data (retail sales, consumer spending, etc.) has remained positive despite concerns about an economic collapse.

Having said that, while the tariffs/ trade war hasn’t really damaged the economy much, they’ve been absolute hell for the stock market. The April market meltdown erased over $11 trillion in wealth. And even now that the Trump administration is actually closing trade deals, those companies that have broad exposure to tariffs are struggling.

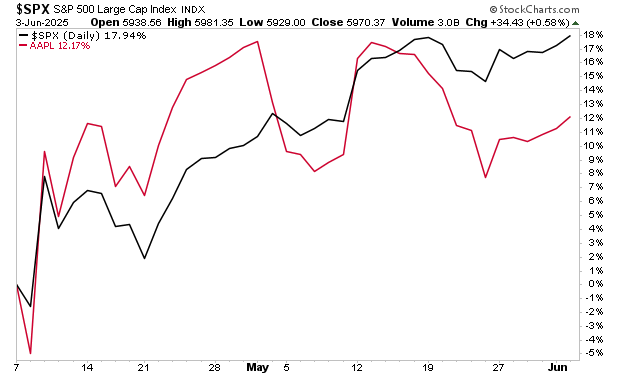

Take a look at Apple (AAPL), arguably one of the greatest, most profitable companies in history. AAPL is a cash spewing juggernaut with a sticky ecosystem that generates tremendous brand loyalty from consumers. The company cranks out ~$100 BILLION in free cash flow per year: an amount greater than the market capitalizations of MOST companies on the S&P 500.

However, AAPL also has considerable exposure to tariffs/ the trade war. The company has over 500 suppliers located throughout the world. And the majority of its products are made overseas in China: the country the Trump administration has singled out as the worst offender as far as trade issues are concerned.

Because of this, AAPL shares are struggling, even compared to the broader market. The S&P 500 is up almost 18% from the April lows. AAPL shares are up just 12%. And they are failing to catch a bid even on days when the overall market moves higher.

So again, if you don’t own high growth stocks with little to no exposure to the trade war, you’re missing out.

This concludes today’s article. For a list of Special Investment reports we offer to the general public outlining investment opportunities you won’t hear about anywhere else, go to…

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research